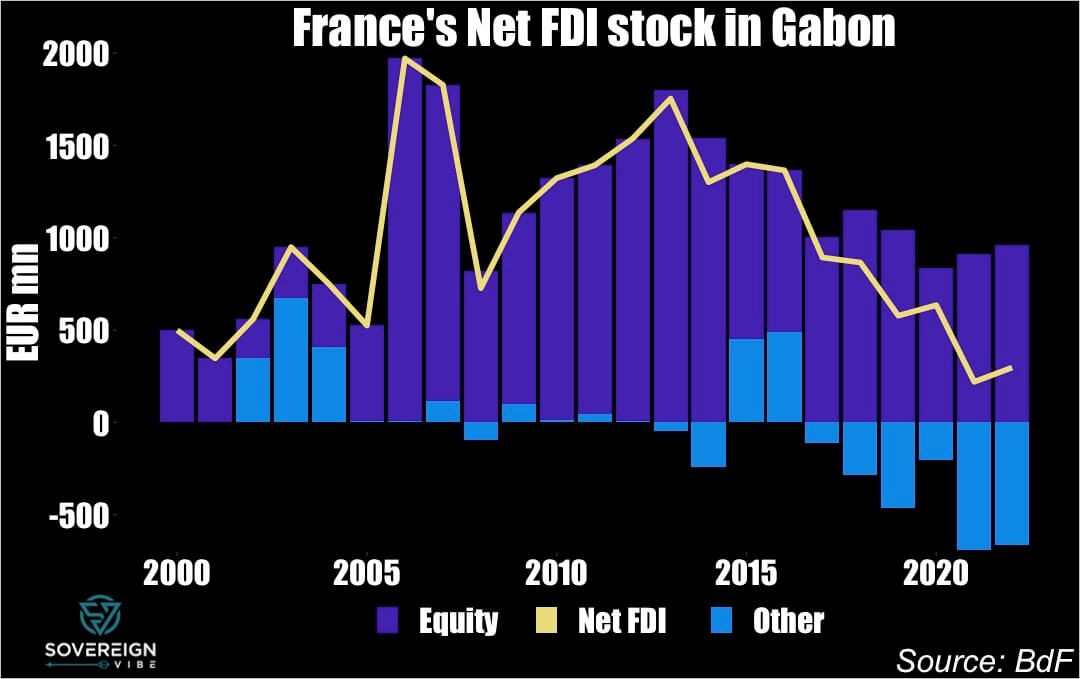

Quick take on Gabon’s coup d’Etat

- Paul Della Guardia

- 2023-08-31

I spent most of 2012 working in Gabon, a gem of a country well-endowed with some of the lushest rainforest on the planet, abundant natural resources – oil, manganese, wood – and a small population. Like many observers, I was aware of the concerns leading up to the August 2023 presidential elections as President Ali […]

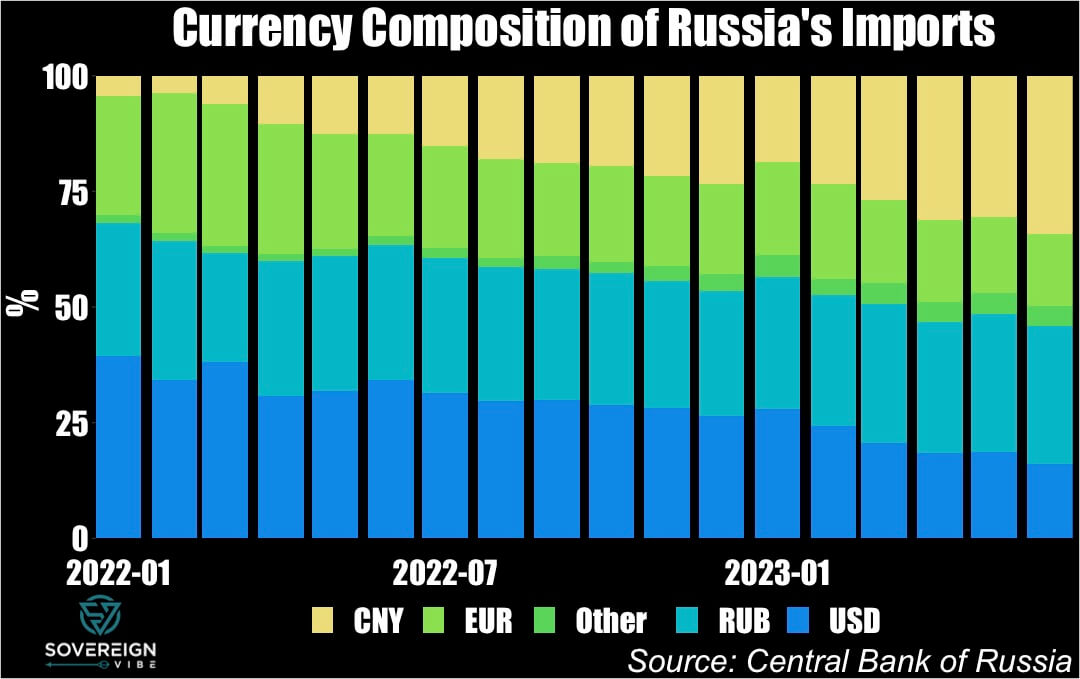

Russia’s trading partners steer clear of rubles

- Paul Della Guardia

- 2023-08-15

Building on a previous post on the de-dollarization debate, a snapshot of Russian trade invoicing data gives a sense of a potentially maximum speed of the dollar’s declining use in some quarters of the global economy, while also revealing how Moscow’s trading partners are willing to part with rubles but unwilling to receive them. As […]

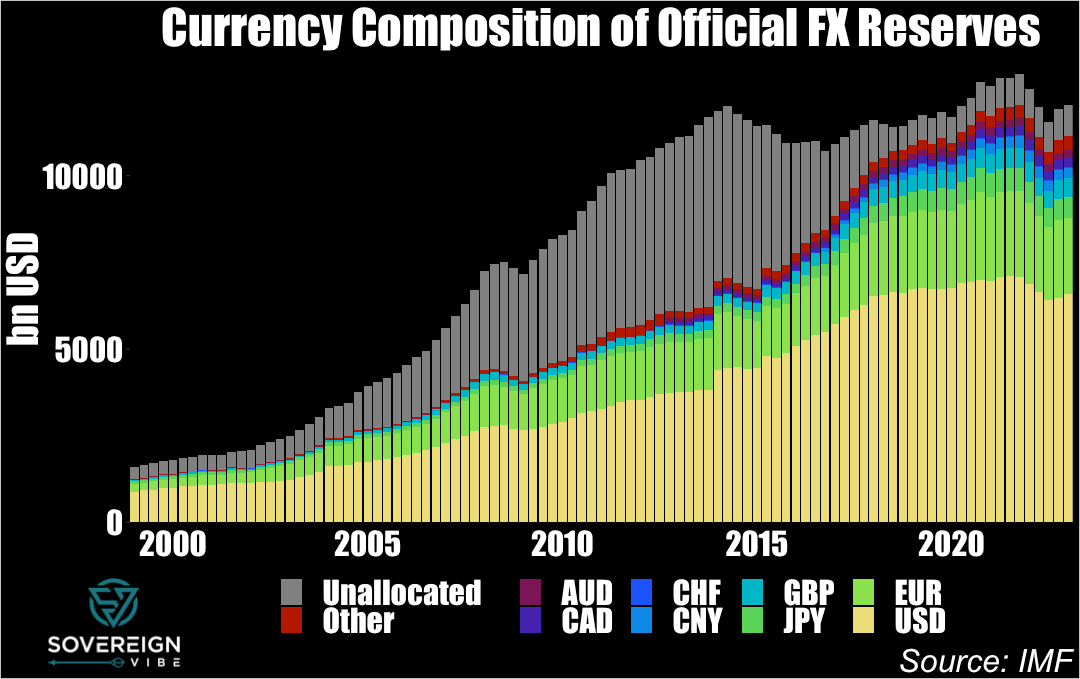

De-dollarization musings

- Paul Della Guardia

- 2023-07-21

De-dollarization has become an increasingly popular topic in recent years, and for good reason. Indeed, the global economy has been gradually entering a period of deglobalization for the past decade or so, and, in parallel, the U.S.-led nature of the international economic order is facing challenges from geopolitical competitors and a disenchanted Global South. Yet […]

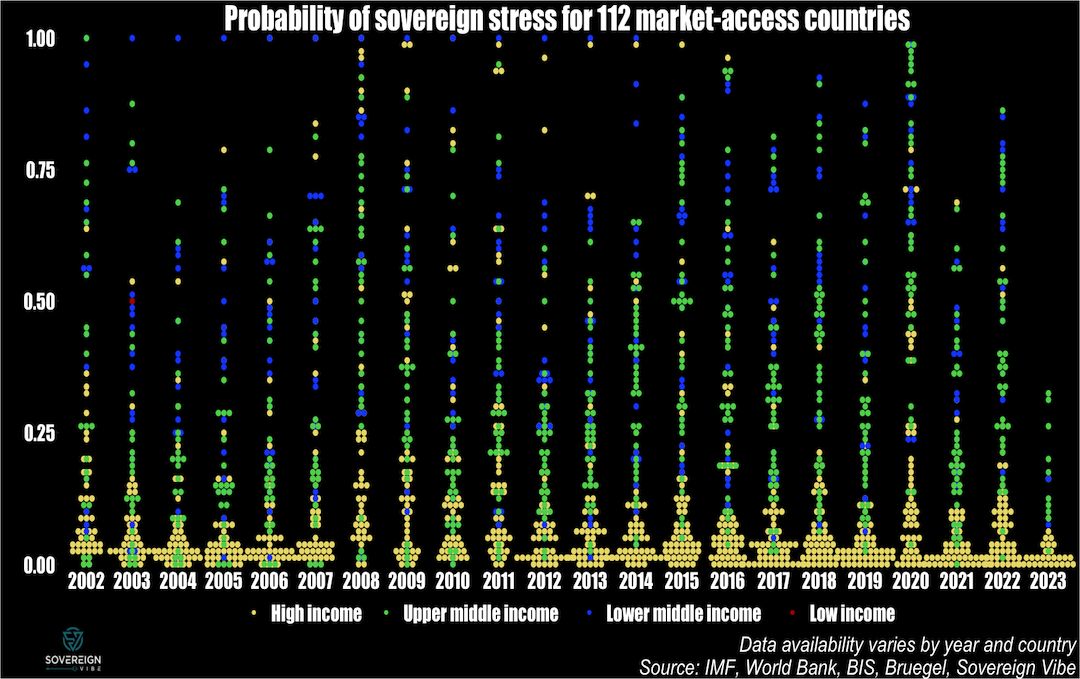

Tracking sovereign stress in 112 countries

- Paul Della Guardia

- 2023-06-21

Introducing a sovereign stress tracker covering 100+ countries, based on the IMF’s Debt Sustainability Framework for Market-Access Countries. The model used in this analysis suggests that sovereign debt strains are lower in 2023 than they were in either 2022 or 2020 for this group of countries. MACs comprise all economies that are lower-middle income and […]

Update: Debt Dashboard for Low-Income Countries

- Paul Della Guardia

- 2023-06-09

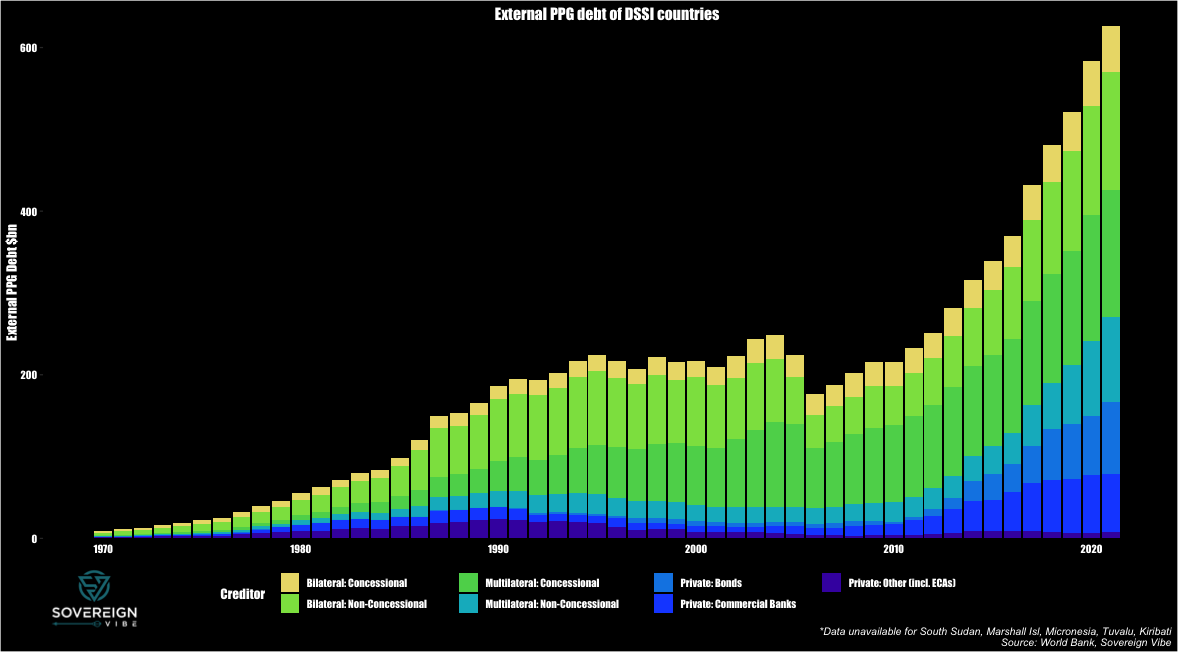

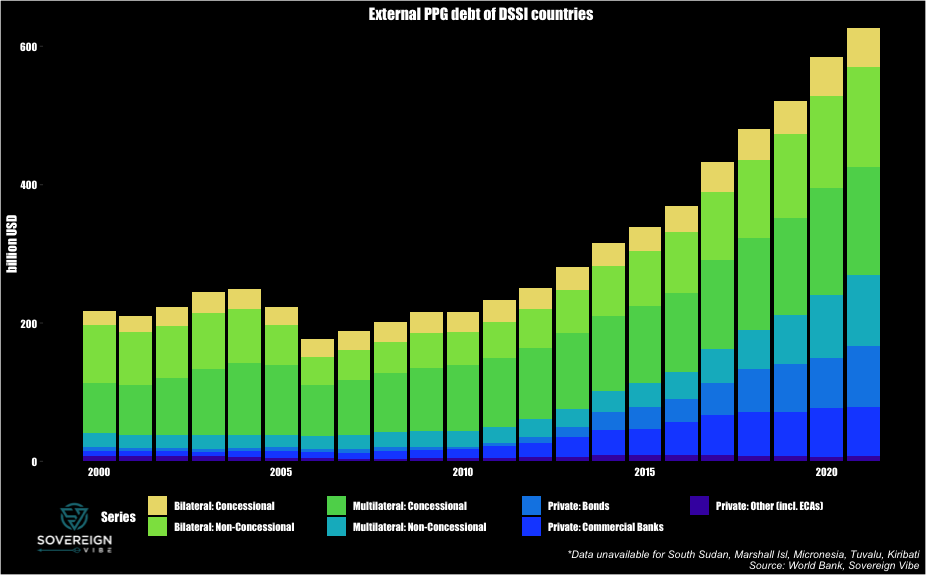

The first web application as part of Sovereign Vibe’s DataHub disaggregates the World Bank’s International Debt Statistics’ outstanding debt stock data for 68 low-income countries by creditors type: multilateral, bilateral, and private. Further decompositions are provided for the concessional and non-concessional components of multilateral and bilateral lending, and also for private credit by bondholders, banks, […]

Cure worse than the disease

- Paul Della Guardia

- 2023-05-19

A high-level snapshot of the structure of outstanding external sovereign debt burdens for low-income countries and reflections on the G20’s pandemic-era DSSI policy and its successor, the Common Framework for Debt Treatments beyond the DSSI. LIC debt burdens During last month’s IMF-World Bank Spring Meetings, I listened to a discussion on debt crisis resolution between […]

Welcome!

- Paul Della Guardia

- 2023-05-08

Introducing the Sovereign Vibe project in this first blog post, for your reading pleasure. What is Sovereign Vibe? Sovereign Vibe is a data-focused blog designed to provide actionable insights on emerging markets sovereign debt, global macroeconomics, and capital markets. And by “emerging markets” and “global macroeconomics,” what I really mean is that this blog will […]