On a quest for output gaps

- Paul Della Guardia

- 2023-11-24

One of the holy grails in the economics profession is to accurately measure an economy’s output gap, which is the difference between its actual GDP and potential GDP. Having an accurate representation of an output gap is useful for all sorts of economic modeling purposes, given statistical relationships with inflation, exchange rates, and a host […]

Sovereign stress dashboard for 82 MACs

- Paul Della Guardia

- 2023-11-06

:root {–wt-primary-color: #19757f;–wt-text-on-primary-color: #FFFFFF;–wt-secondary-color: #FDF8F2;–wt-text-on-secondary-color: #504a40;–wt-tertiary-color: #FFFFFF;–wt-text-on-tertiary-color: #222222;–wt-background-color: #FDF8F2;–wt-text-on-background-color: #23201a;–wt-subscribe-background-color: #FDF8F2;–wt-text-on-subscribe-background-color: #23201a;–wt-header-font: “Helvetica”, ui-sans-serif, system-ui, -apple-system, BlinkMacSystemFont, “Segoe UI”, Roboto,”Helvetica Neue”, Arial, “Noto Sans”, sans-serif, “Apple Color Emoji”, “Segoe UI Emoji”, “Segoe UI Symbol”, “Noto Color Emoji”;–wt-body-font: “Helvetica”, ui-sans-serif, system-ui, -apple-system, BlinkMacSystemFont, “Segoe UI”, Roboto, “Helvetica Neue”, Arial, “Noto Sans”, sans-serif, “Apple Color Emoji”, “Segoe […]

Sovereign stress dashboard for 82 MACs

- Paul Della Guardia

- 2023-11-06

Following the release of sovereign debt stress heatmaps for 82 market-access countries, the underlying data for nine indicators for near-term risks is now available in the dashboard below. This first iteration facilitates visualization of each variable since 2010, with the possibility of viewing multiple countries simultaneously for comparative purposes. This tool is based directly on […]

Sovereign debt stress heatmaps

- Paul Della Guardia

- 2023-10-26

:root {–wt-primary-color: #19757f;–wt-text-on-primary-color: #FFFFFF;–wt-secondary-color: #FDF8F2;–wt-text-on-secondary-color: #504a40;–wt-tertiary-color: #FFFFFF;–wt-text-on-tertiary-color: #222222;–wt-background-color: #FDF8F2;–wt-text-on-background-color: #23201a;–wt-subscribe-background-color: #FDF8F2;–wt-text-on-subscribe-background-color: #23201a;–wt-header-font: “Helvetica”, ui-sans-serif, system-ui, -apple-system, BlinkMacSystemFont, “Segoe UI”, Roboto,”Helvetica Neue”, Arial, “Noto Sans”, sans-serif, “Apple Color Emoji”, “Segoe UI Emoji”, “Segoe UI Symbol”, “Noto Color Emoji”;–wt-body-font: “Helvetica”, ui-sans-serif, system-ui, -apple-system, BlinkMacSystemFont, “Segoe UI”, Roboto, “Helvetica Neue”, Arial, “Noto Sans”, sans-serif, “Apple Color Emoji”, “Segoe […]

Sovereign debt stress heatmaps

- Paul Della Guardia

- 2023-10-26

Angola, Pakistan, Egypt, Jordan, Argentina, El Salvador, Ecuador, and Belize are among the market-access countries most at risk of sovereign stress, according to the model presented below. Unsurprisingly, several advanced economies appear least at risk, including Norway, Ireland, Denmark, Singapore, the Netherlands, Luxembourg, Hong Kong, and Switzerland. Earlier this year I published the high-level initial […]

Multilateralism limps onward in Marrakech

- Paul Della Guardia

- 2023-10-16

:root {–wt-primary-color: #19757f;–wt-text-on-primary-color: #FFFFFF;–wt-secondary-color: #FDF8F2;–wt-text-on-secondary-color: #504a40;–wt-tertiary-color: #FFFFFF;–wt-text-on-tertiary-color: #222222;–wt-background-color: #FDF8F2;–wt-text-on-background-color: #23201a;–wt-subscribe-background-color: #FDF8F2;–wt-text-on-subscribe-background-color: #23201a;–wt-header-font: “Helvetica”, ui-sans-serif, system-ui, -apple-system, BlinkMacSystemFont, “Segoe UI”, Roboto,”Helvetica Neue”, Arial, “Noto Sans”, sans-serif, “Apple Color Emoji”, “Segoe UI Emoji”, “Segoe UI Symbol”, “Noto Color Emoji”;–wt-body-font: “Helvetica”, ui-sans-serif, system-ui, -apple-system, BlinkMacSystemFont, “Segoe UI”, Roboto, “Helvetica Neue”, Arial, “Noto Sans”, sans-serif, “Apple Color Emoji”, “Segoe […]

Multilateralism limps onward in Marrakech

- Paul Della Guardia

- 2023-10-16

The World Bank Group-International Monetary Fund Annual Meetings drew to a close in Marrakech this past weekend, the first time these events have been held in Africa since the 1973 edition in Nairobi. While the Bank-Fund leadership expressed their usual endorsement of international cooperation and optimism for the future, this year’s agenda also explicitly aimed […]

Credit gaps cool globally

- Paul Della Guardia

- 2023-10-05

:root {–wt-primary-color: #19757f;–wt-text-on-primary-color: #FFFFFF;–wt-secondary-color: #FDF8F2;–wt-text-on-secondary-color: #504a40;–wt-tertiary-color: #FFFFFF;–wt-text-on-tertiary-color: #222222;–wt-background-color: #FDF8F2;–wt-text-on-background-color: #23201a;–wt-subscribe-background-color: #FDF8F2;–wt-text-on-subscribe-background-color: #23201a;–wt-header-font: “Helvetica”, ui-sans-serif, system-ui, -apple-system, BlinkMacSystemFont, “Segoe UI”, Roboto,”Helvetica Neue”, Arial, “Noto Sans”, sans-serif, “Apple Color Emoji”, “Segoe UI Emoji”, “Segoe UI Symbol”, “Noto Color Emoji”;–wt-body-font: “Helvetica”, ui-sans-serif, system-ui, -apple-system, BlinkMacSystemFont, “Segoe UI”, Roboto, “Helvetica Neue”, Arial, “Noto Sans”, sans-serif, “Apple Color Emoji”, “Segoe […]

Credit gaps cool globally

- Paul Della Guardia

- 2023-10-05

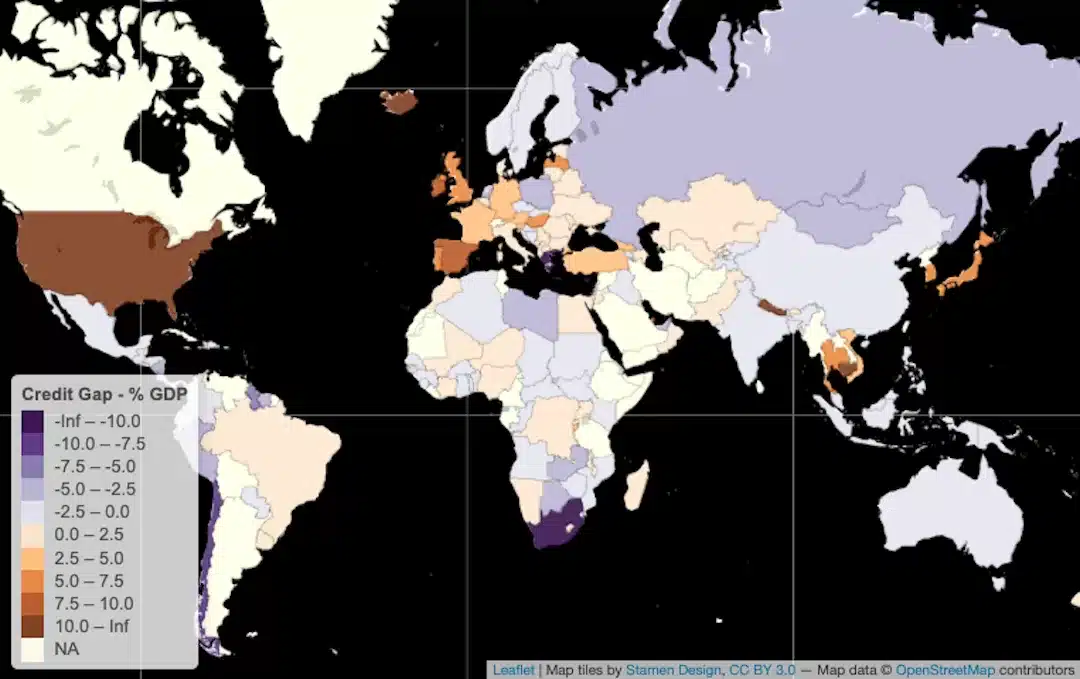

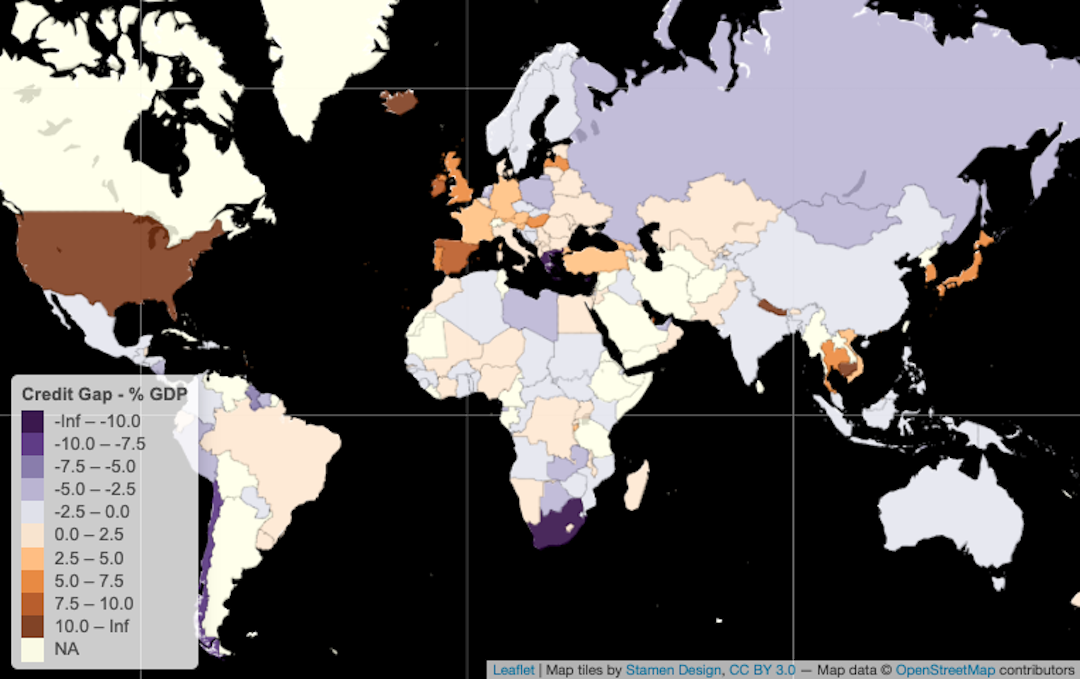

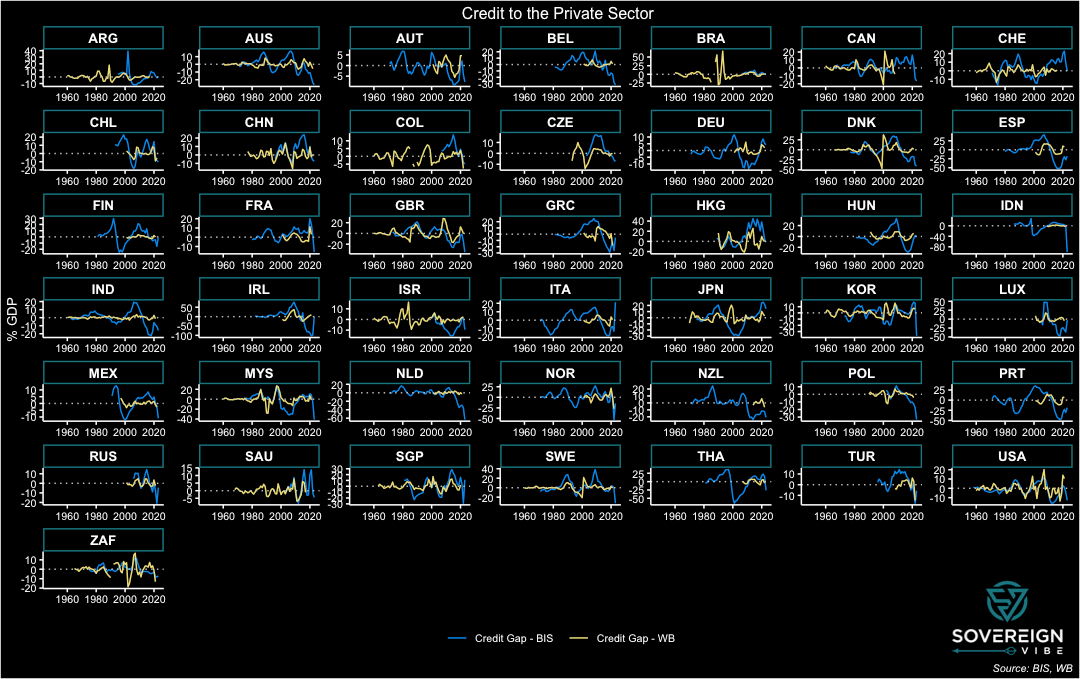

This post follows on from previous credit gap analysis on this blog and how this indicator helps estimate the probability of sovereign debt strains, for which Bank of International Settlements data is of great use. However, the BIS data covers “only” 43 countries and the Euro Area, which roughly corresponds to the G20 – including […]

Mind the credit gap

- Paul Della Guardia

- 2023-09-24

:root {–wt-primary-color: #19757f;–wt-text-on-primary-color: #FFFFFF;–wt-secondary-color: #FDF8F2;–wt-text-on-secondary-color: #504a40;–wt-tertiary-color: #FFFFFF;–wt-text-on-tertiary-color: #222222;–wt-background-color: #FDF8F2;–wt-text-on-background-color: #23201a;–wt-subscribe-background-color: #FDF8F2;–wt-text-on-subscribe-background-color: #23201a;–wt-header-font: “Helvetica”, ui-sans-serif, system-ui, -apple-system, BlinkMacSystemFont, “Segoe UI”, Roboto,”Helvetica Neue”, Arial, “Noto Sans”, sans-serif, “Apple Color Emoji”, “Segoe UI Emoji”, “Segoe UI Symbol”, “Noto Color Emoji”;–wt-body-font: “Helvetica”, ui-sans-serif, system-ui, -apple-system, BlinkMacSystemFont, “Segoe UI”, Roboto, “Helvetica Neue”, Arial, “Noto Sans”, sans-serif, “Apple Color Emoji”, “Segoe […]

Mind the credit gap

- Paul Della Guardia

- 2023-09-24

As part of tracking the probability of credit stress among 112 sovereign issuers, one of the variables of interest in the IMF’s model is the credit-to-GDP gap. This indicator matters not only because of its predictive power for sovereign credit events but for many other reasons as well, including monetary policy transmission and government borrowing. […]

France’s FDI in Africa

- Paul Della Guardia

- 2023-09-15

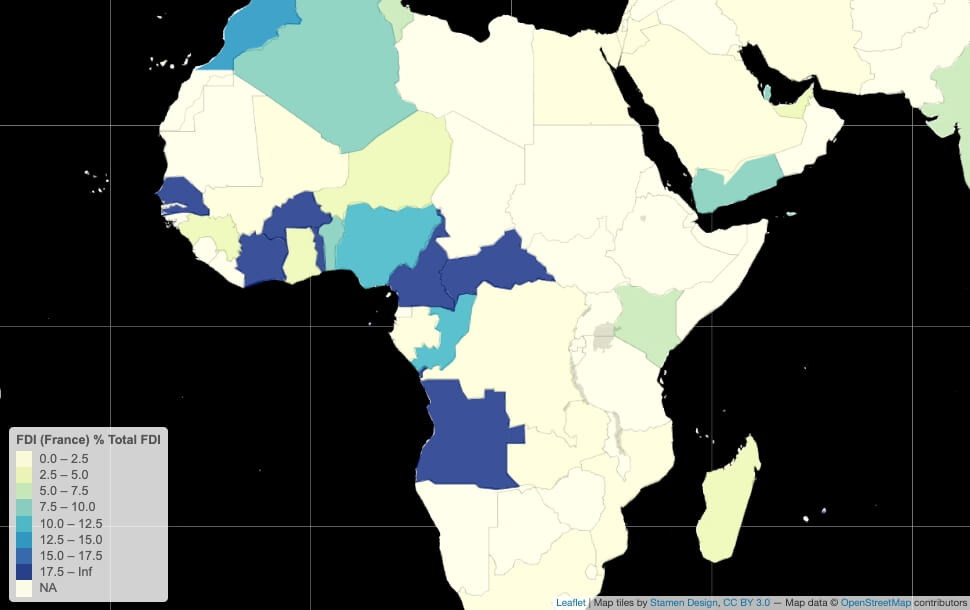

The recent wave of coups in Africa has increased scrutiny of France’s role on the continent. Looking at France’s net stocks of foreign direct investment in its former colonies reveals some surprises for those not closely monitoring these trends, and helps provide some sense of where Paris’s relations are with this group of countries. A […]