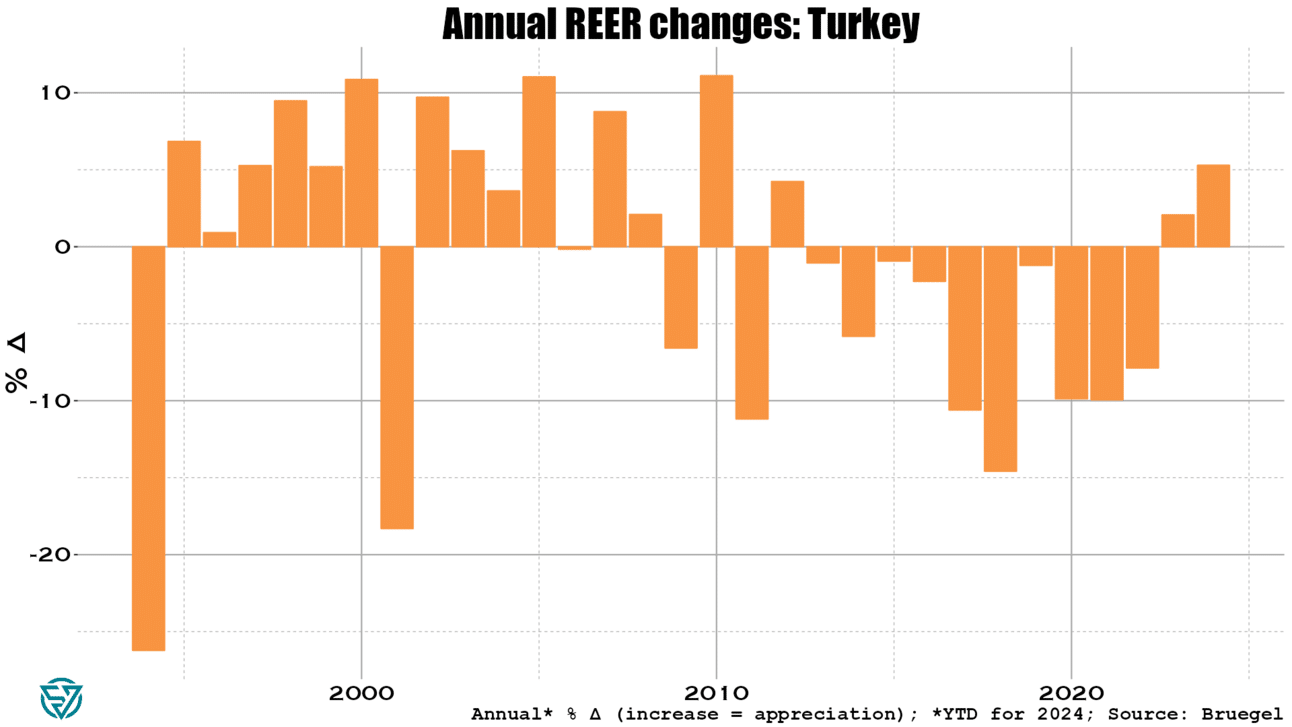

Is another crisis brewing in Turkey?

- Paul Della Guardia

- 2024-07-13

Looking across the emerging markets complex, Turkey stands out as one of the larger, systemic EMs that is rapidly headed in the wrong direction. Inflation has of course been the main symptom of imbalances in the economy, gyrating between 40-80% since 2022. It currently stands at around 70%, despite the central bank hiking the policy […]

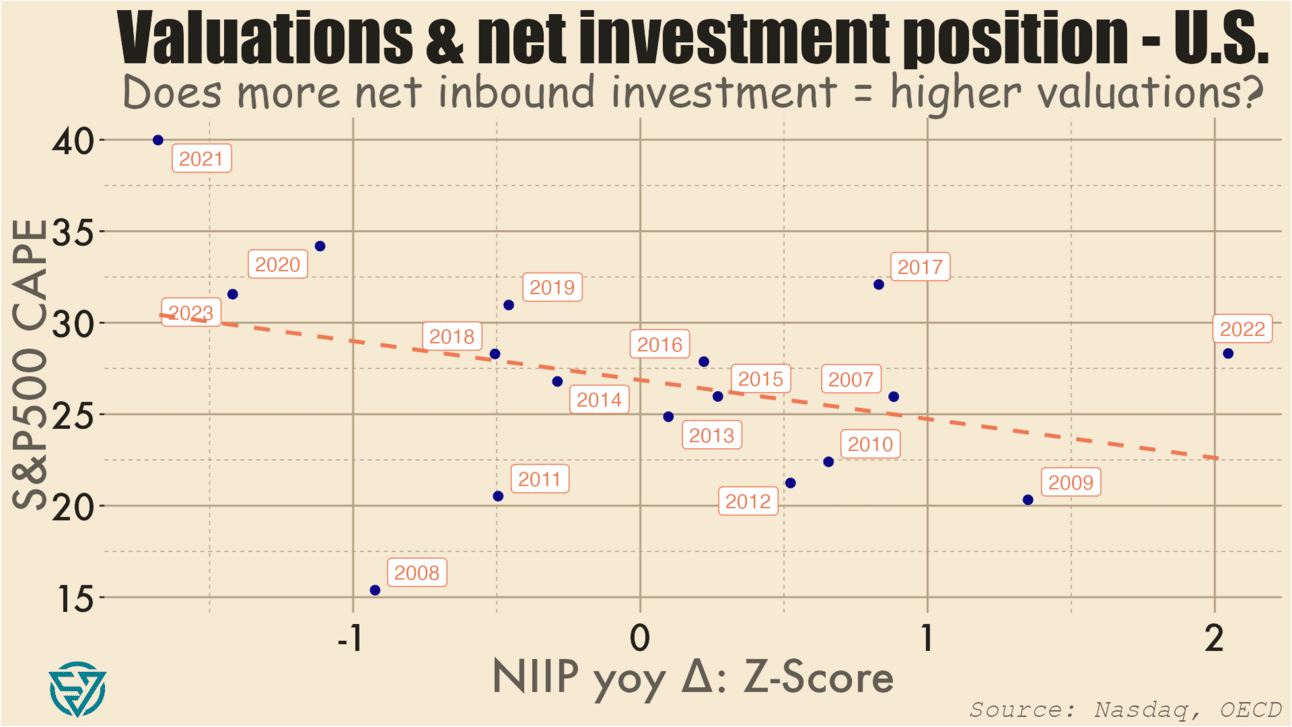

The $20 trillion investment gap

- Paul Della Guardia

- 2024-07-03

In last week’s post, I discussed savings and investment across large emerging markets and the G7 countries. As has been well-documented, imbalances in the G7 have profound consequences not only on domestic economies and the rise of populism. High consumption and the low savings that result across the G7, especially ex-Japan / Germany, means that […]

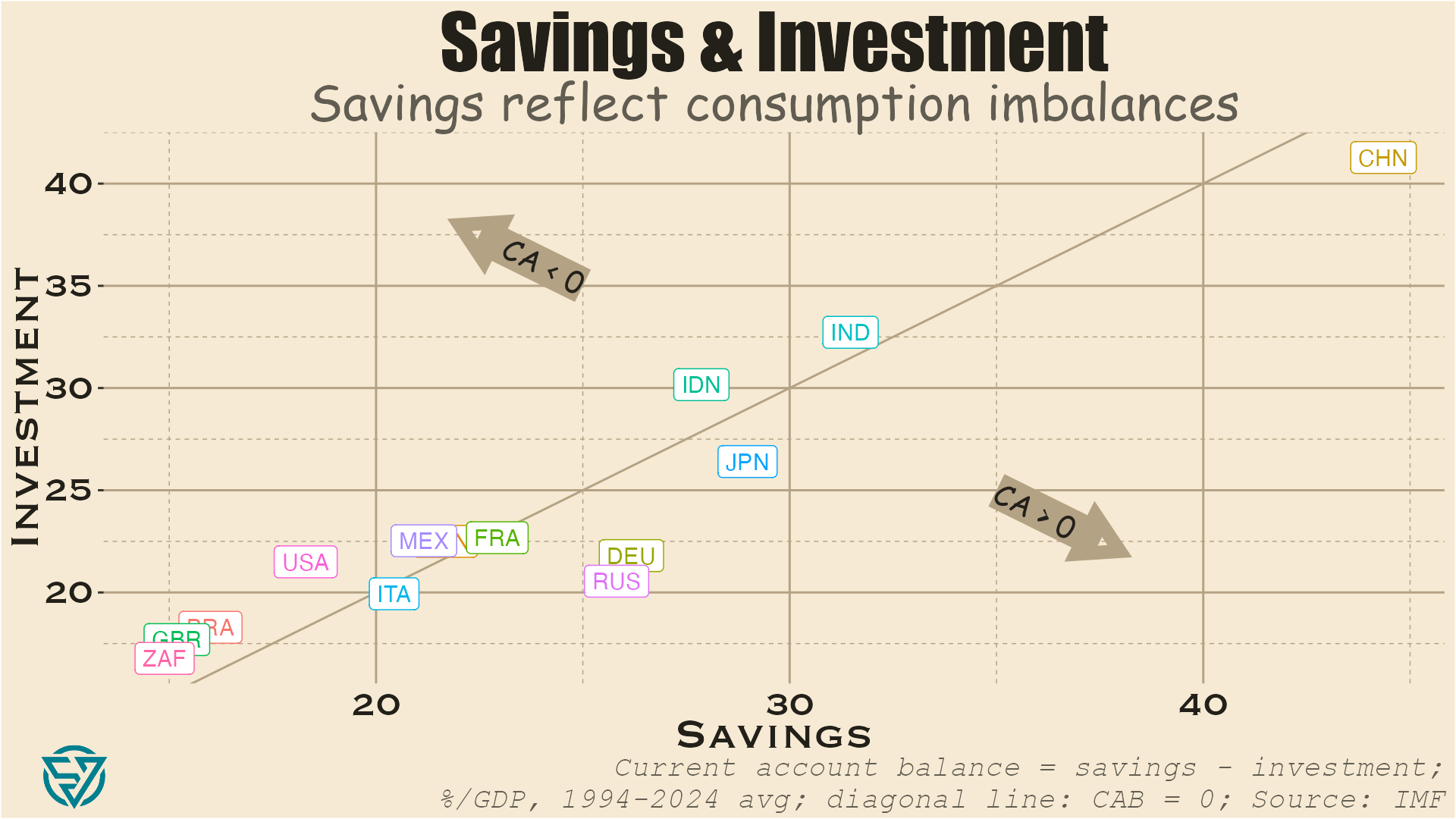

Is the G7 the new EM?

- Paul Della Guardia

- 2024-06-26

The past few weeks of political headlines have provided yet more confirmation of a long-term trend: the distinction between emerging and developed markets is less clear than it once was. Emerging and frontier markets are less politically stable, or so the old consensus goes. Yet Emmanuel Macron has flown in the face of all that […]

China’s lending to developing nations declines

- Paul Della Guardia

- 2024-06-18

Behold the dashboard for low- and middle-income country external sovereign debt! After peaking at $188 billion in 2021, for the first time in two decades the stock of low- and middle-income country sovereign debt that China holds declined in 2022. At just under $181 billion, this is still more than the US, France, the UK, […]

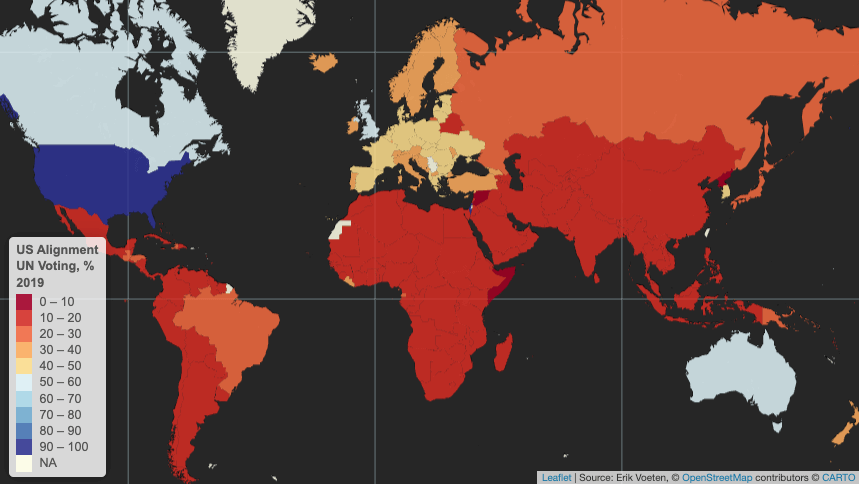

The Geopolitics of Sovereign Debt

- Paul Della Guardia

- 2024-06-11

EMDE sovereign borrowers walk a tightrope in the fragmented creditor landscape. One of the main themes permeating the 7th edition of the Sovereign Debt Research and Management Conference – aka “DebtCon” – held in Paris on 29-31 May was the increasingly challenging environment that sovereign borrowers face in accessing international capital and managing their balance […]

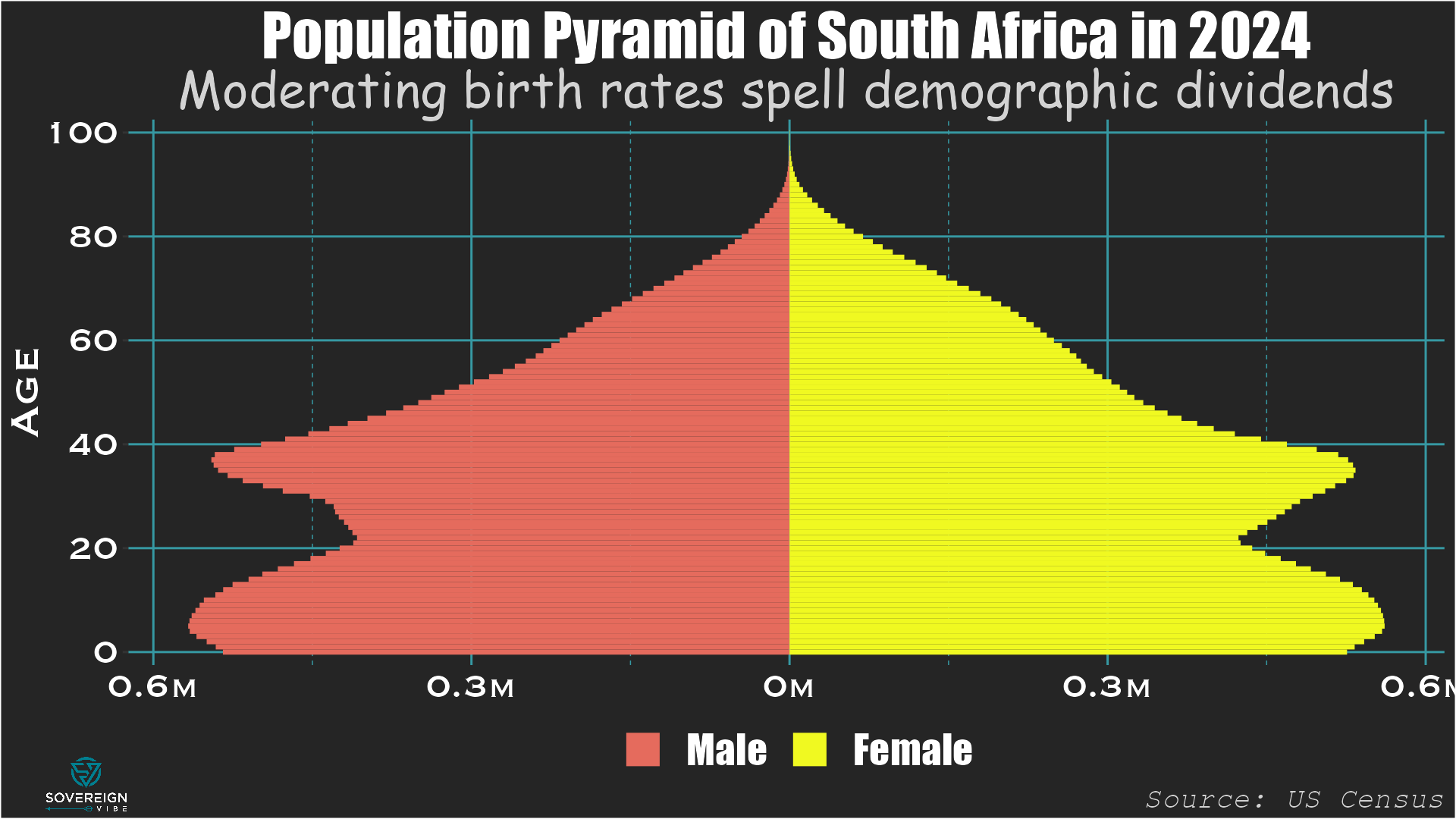

South Africa enters uncharted waters

- Paul Della Guardia

- 2024-06-03

With the African National Congress party having endured a crushing defeat in South Africa’s election on May 29th, the political horse-trading around forming a minority government is already well under way. The final tally shows the ANC receiving 40% of the votes and 159 of the parliament’s 400 seats, a sharp drop from the 230 […]

Energy sanctions on Russia failing to bite

- Paul Della Guardia

- 2024-05-27

Emmanuel Macron wasn’t the only person traveling from France to Berlin last week: I was as well, to attend the inaugural Berlin Energy Forum on May 21st. Here are the key takeaways: Missed opportunity The West had the opportunity to wreck the Russian economy in 2022, as its sanctions in response to the Russian military’s […]

Tracking sovereign stress in 45 emerging markets

- Paul Della Guardia

- 2024-05-20

Today’s charts are an update of the Sovereign Vibe sovereign debt stress tracker initially released in 2023. This tool is based directly on the IMF’s Debt Sustainability Framework for Market-Access Countries, released in 2021, and is relevant only for countries that “principally receive financing through market-based instruments and on non-concessional terms.” Through extensive testing, the […]

Egypt: short-term pain, long-term gain

- Paul Della Guardia

- 2024-05-13

Famous last words, but this time could be different. Big things are happening with Egypt’s economic policy management, and investors are taking notice. Though as with any other emerging market, the question that shouldn’t be asked is so often the same: is this time different? One of the most obvious symptoms of change is the […]

EM is ahead of DM in the global credit cycle

- Paul Della Guardia

- 2024-05-06

Today’s charts are snapshots of credit-to-GDP gaps in emerging and advanced economies. As a reminder, the credit gap measures the difference between actual credit to the private sector and trend credit to the private sector. These estimates through Q3 2023 are provided by the Bank for International Settlements, which describes its credit-to-GDP ratio as capturing […]

Supply constraints are driving US inflation

- Paul Della Guardia

- 2024-05-02

Higher for (a bit) longer, but don’t buy into inflationista hype. I wrote recently that emerging market sovereigns considering new issuance should be ready for Federal Reserve rate cuts in 2024, despite the hot Q1 inflation prints. The point is that core goods inflation has all but disappeared from the consumer price index and that […]

What does US inflation mean for EM sovereigns?

- Paul Della Guardia

- 2024-04-29

Debt management offices in emerging market finance ministries should be prepared for Fed rate cuts. Emerging market sovereign debt issuance started 2024 off strongly with record-breaking issuance in January at ~$47bn and another ~$16bn in February, marking the highest January-February result since before the pandemic. Sub-Saharan African sovereigns even returned to the Eurobond market, with […]