Are geopolitical risks priced in?

- Paul Della Guardia

- 2024-04-25

Oil prices have actually declined in the wake of Iran-Israel. In remarks made on Tuesday this week, JPMorgan Chase boss Jamie Dimon stated, among other things, that he’s surprised at oil not rising further amid recent geopolitical tensions. Brent crude has mostly been trading in the $85-90 range over the past month, though that is […]

The dollar-debt imbalance

- Paul Della Guardia

- 2024-04-22

One of the major announcements at last week’s World Bank/IMF Spring Meetings concerns the unsustainable rise in US government debt. While it’s old news that the budget deficit is large – $1.7tn / 6.3% of GDP in 2023 and a projected $1.6tn in 2024, I want to highlight how US debt relates to the the […]

Wall Street’s fear gauge rises

- Paul Della Guardia

- 2024-04-18

The headline article in yesterday’s FT focused on the “soaring” Vix index, a well-known measure of investor skittishness. Much ado about VIX VIX rises when market participants expect more volatility in the S&P 500, as it reflects the cost of buying options used to profit from changes in stock prices. It’s clear that markets are […]

The Modi mojo is working

- Paul Della Guardia

- 2024-04-15

India’s economy is in great shape as it heads to the polls… but something’s off. With India’s general elections getting under way on Friday, much of the focus this week will be on the world’s most populous country and largest democracy. So here are some charts to help you look beyond the headlines and arm […]

Central banks to weigh on 2024 markets

- Paul Della Guardia

- 2024-04-10

As global markets grapple with the prospect of higher rates for longer, it’s important to keep an eye on another important potential headwind: the direction of worldwide central bank asset purchases. Without delving too deeply into the history of unconventional monetary policy, post-Global Financial Crisis the world’s major central banks implemented quantitative easing programs. This […]

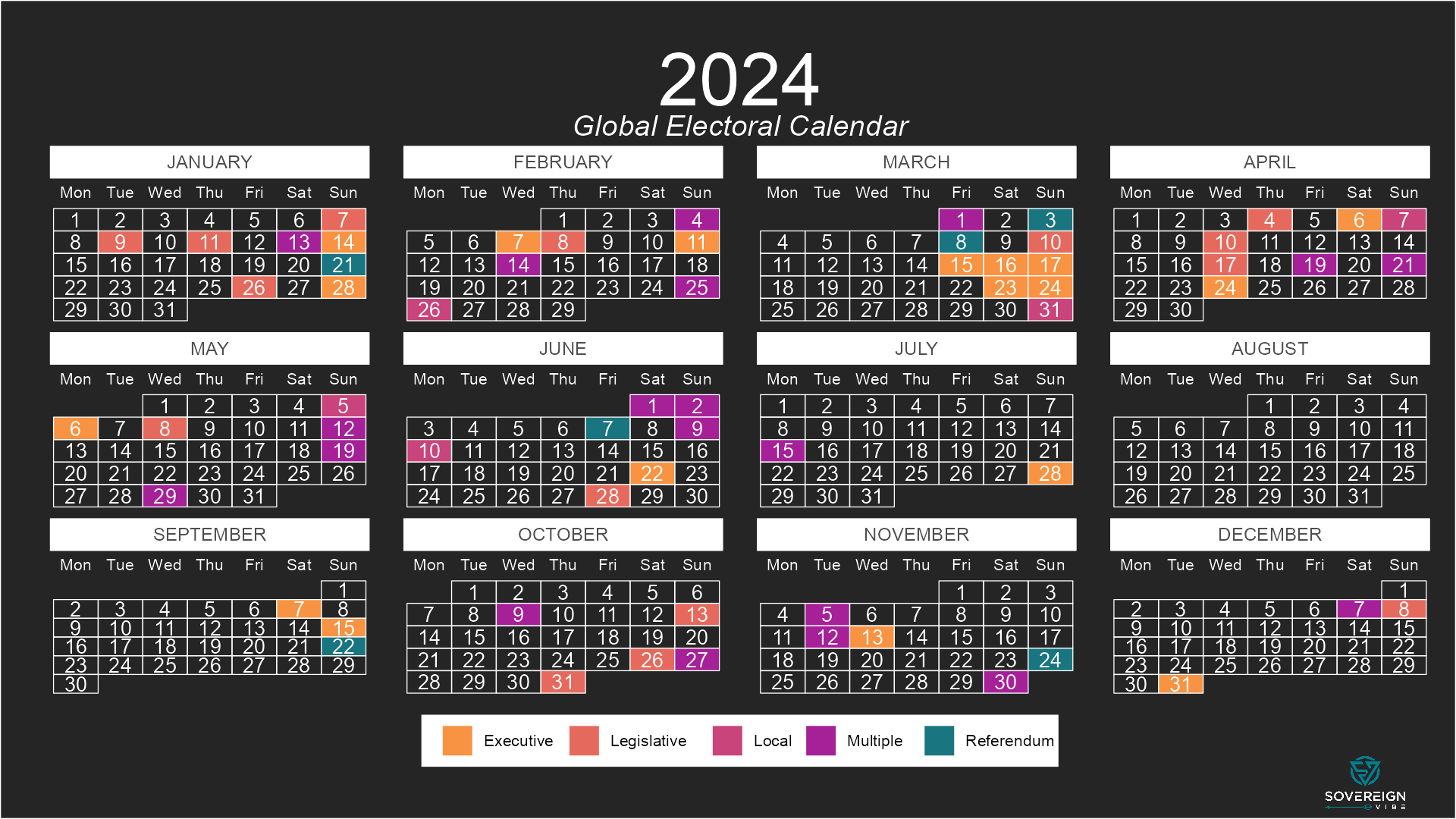

Populist forces on the march

- Paul Della Guardia

- 2024-04-08

With so much of the world headed to the polls in 2024, a quick stock-take of results so far and a look ahead are in order. The outcome of each contest shapes broader international trends of deglobalization. Of populists & liberals The paradox is that both populist and liberal political parties have pursued policies leading […]

Senegalese exceptionalism, for now 🇸🇳

- Paul Della Guardia

- 2024-04-03

Today’s spotlight is on Senegal’s presidential election in March 2024 and the spectacular rise to power of political novice Bassirou “Diomaye” Faye, a 44-year old former tax inspector who went from prison to the presidency in scarcely 10 days. Digging beneath the surface of the electoral results reveals some oft-neglected ethnic undercurrents at play in […]

Rise of the yuan? Not so fast

- Paul Della Guardia

- 2024-04-01

Berkeley-based economist and titan of the profession Barry Eichengreen notes that the dollar’s reserve currency status is continuing to erode in favor of “non-traditional reserve currencies”. But looking closely at the same recently-released IMF data through Q4 2023 paints a more nuanced picture. At end-2016, the IMF reclassified yuan holdings from “other” to its own […]

On the hunt for Russia’s reserves

- Paul Della Guardia

- 2024-03-22

When it comes to appropriating Russia’s central bank reserves for supporting Ukraine, some influential Western constituencies seem to think that the G7 leadership can and should dish out punishment without considering trifling matters such as due process. Such has been the Western enthusiasm for championing the Ukrainian cause, that they might have been right about […]

Fair value exchange rates in EM Asia

- Paul Della Guardia

- 2024-03-14

FX fair value estimates for eight EM Asia economies point to more over- rather than under-valuation across the region… …so the real depreciations registered by most of the region’s currencies last year has pushed many (but not all) towards fair value. Inflation differentials are now playing a larger role in determining REERs compared to the […]

Fair value exchange rates in EM Asia

- Paul Della Guardia

- 2024-03-14

Currencies in emerging markets Asia mostly declined in real terms in 2023. Pakistan registered the sharpest real exchange rate depreciation, though China also weakened significantly on the back of much less inflationary pressure in the country relative to its trading partners. REER trends in EM Asia Of the eight EM Asia countries covered below, only […]

Ukraine: two, ten, or thirty years on?

- Paul Della Guardia

- 2024-02-24

Today marks the grim anniversary of Russia’s full-scale invasion of Ukraine on February 24, 2022. Yet the conflict since 2022 is in many ways larger than the current military operations on the ground, both in terms of time and space. It is of course only the latest and most intense iteration of Russian aggression in […]