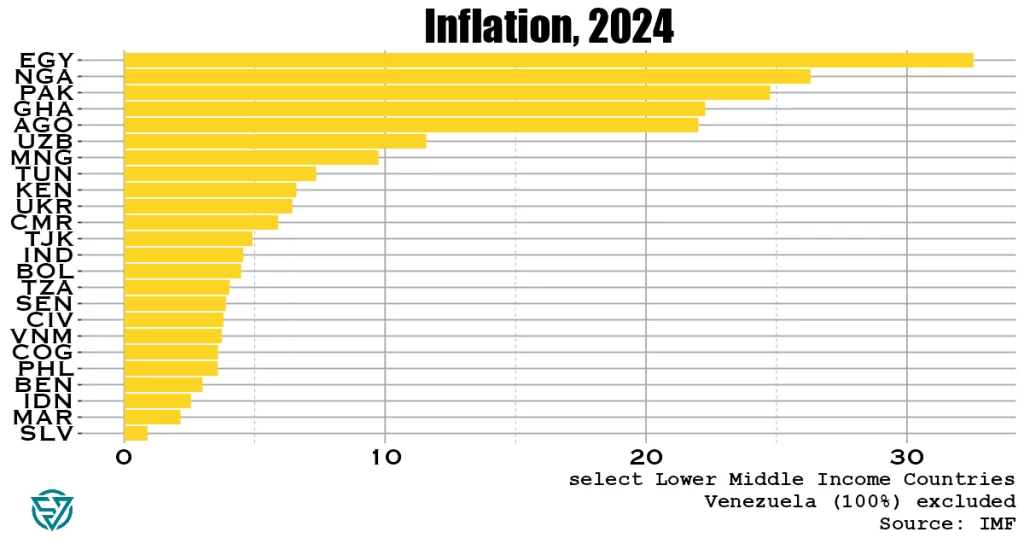

Rampant inflation is most prevalent in lower-middle income countries, except for Argentina and Turkey.

A recent piece by the ex-head of EM economics at Citi, David Lubin, ponders inflation risk in emerging markets, citing fiscal indiscipline as a major threat to price stability.

So I wanted to visualize cross-country IMF forecasts for EM inflation in 2024 and juxtapose that to see how it tracks with what Lubin is saying.

He mentions South Africa (~4.5%) and Hungary (3.7%) as success stories in reining inflation in to target. In contrast, Lubin notes that Brazil (~4%) and Turkey (~60%) have fiscal policies that are too loose.

Though I would add that South Africa didn’t exactly implement an austerity program in the run-up to its general election in June.

The Fed’s easing cycle and increasing Chinese market share in global exports are both disinflationary forces for EMs, whose battles against inflation could benefit from these benign external forces.

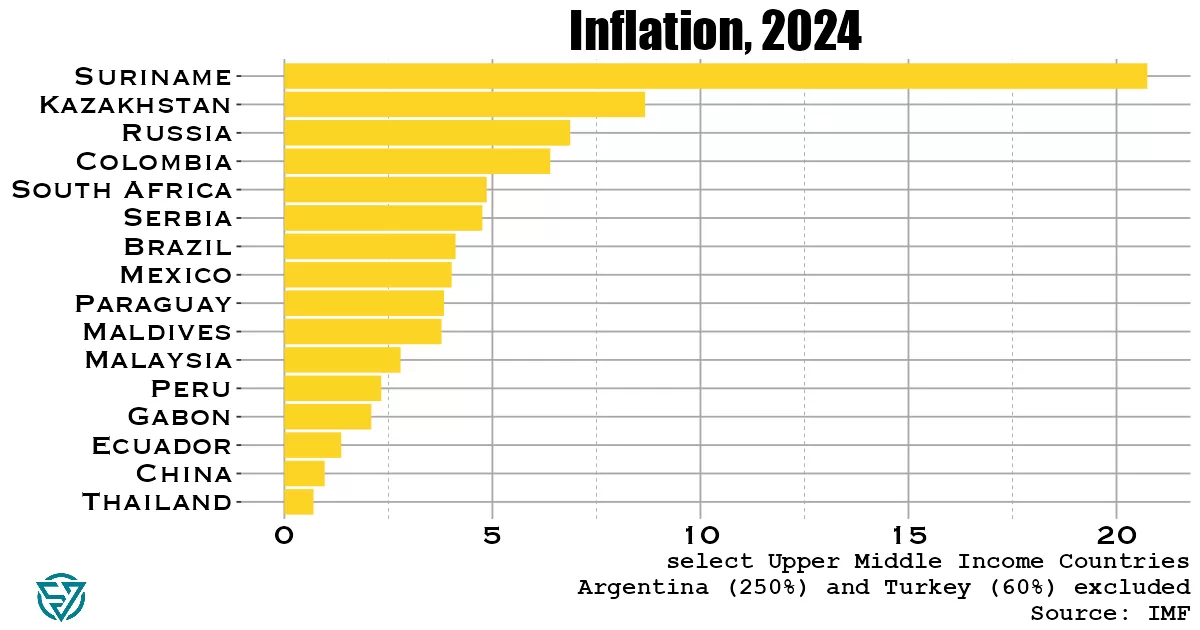

Upper-middle income EMs

In the upper-middle income group of EMs, South Africa and Brazil hardly stand out as particularly successful or unsuccessful in tackling inflation, respectively. Not least because the former has higher inflation numbers than the latter.

Lubin is of course right about Turkey being too expansionary in its fiscal policy, with a potential crisis brewing. According to Lubin, on the monetary front, one issue is that the central bank is under too much pressure to maintain exchange rate stability.

While inflation remains reasonably low in Mexico, Lubin is right to point out the fiscal discipline risks in Mexico, given early indications of new president Claudia Sheinbaum’s policies.

Argentina is in the reverse situation compared to Mexico, with already-rampant inflation (250%!) but leadership that has balanced the budget.

Lower-middle income EMs

Unsurprisingly, inflation is much higher in this poorer sample of countries. Only a handful have inflation rates below 5%.

Lubin notes that fiscal discipline is a risk in Indonesia, though it does have one of the lowest inflation levels in this category.

Though I am surprised to see that Indonesia – and India – are lower-middle income. I’d had them pegged as upper-middle income, given their prominence in the EM universe.

Let’s chalk that up to how confusing the EM asset class is. I get that both countries have large populations, but I thought they would have “emerged” more by now. Thankfully, growth is strong in these two Asian nations.

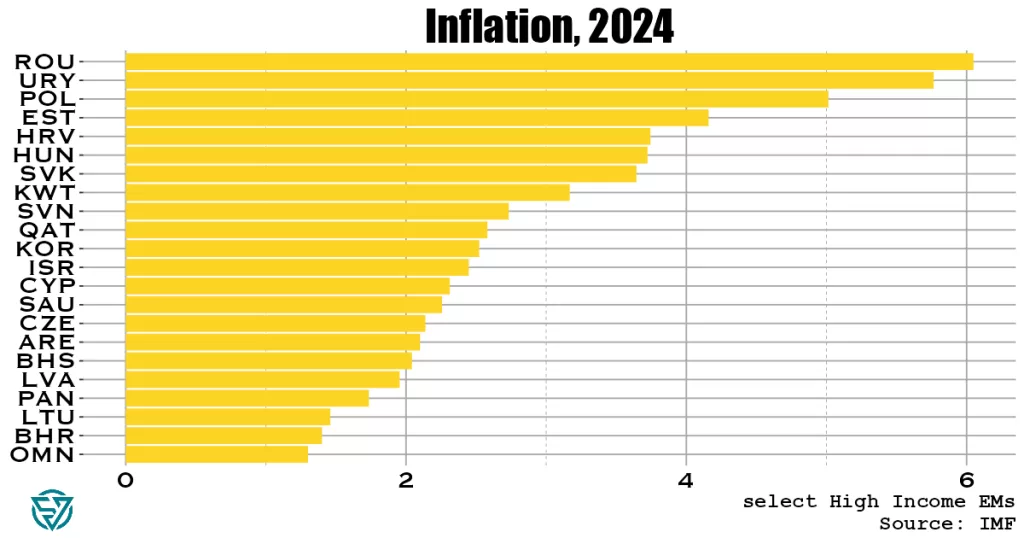

High income EMs

Overall inflation rates are much lower in this group. Romania comes in highest, at a mere 6%.

These are truly developed-country CPI readings, providing yet more reason to abandon the EM designation altogether. Many of these countries have little in common with each other.

Lubin points to potential fiscal indiscipline risks in Poland, which indeed has higher inflation than a more “successful-according-to-Lubin” Hungary.