The Fed’s data-dependence is clouding EM’s mostly-benign cutting cycle outlook.

Investor expectations of Fed policy and the resulting impact on US Treasury yields is increasingly affecting emerging market debt, as markets lurch from one narrative to another in response to data releases.

Volatility in the US Treasury market has surged since last Friday’s blockbuster US non-farm payrolls report, with investors expecting the Fed to slow the rate-cutting cycle.

The strong print dashed hopes of a second large cut at the Fed’s meeting in November, which had risen in the wake of the landmark 50 basis point decrease on September 18th.

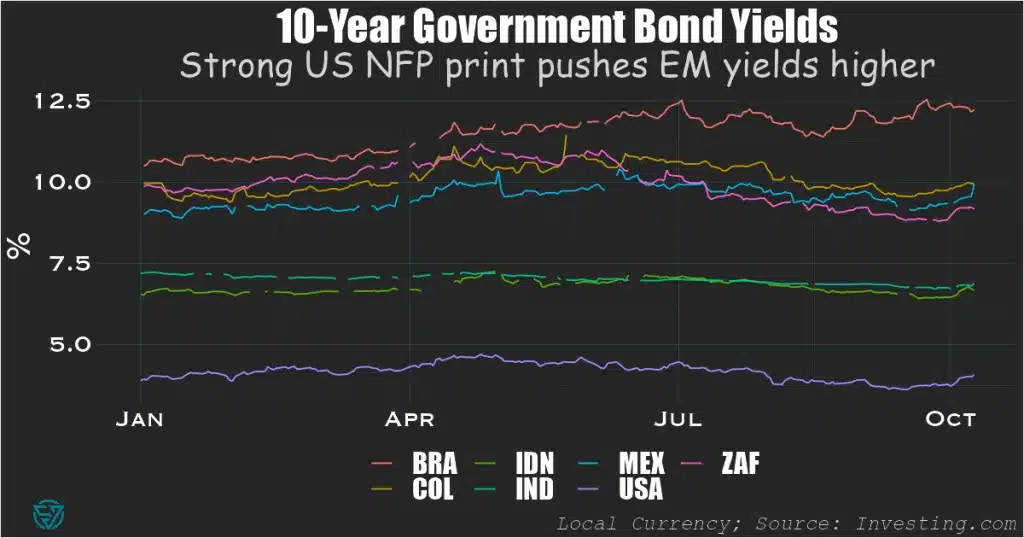

This reversal sent US 10-year Treasuries above the 4% mark, while also placing upward pressure on EM local currency yields so far in October.

This month, ten-year yields are trending higher in India, Indonesia, South Africa (despite a recent rate cut), Mexico, and Colombia. Only Brazil has seen its long-term borrowing costs decline, although these remain elevated.

Mixed picture: today’s US macro data release

Today’s US data release of headline CPI declining to 2.4% in September could place upward pressure on US Treasury yields, as it was above the consensus forecast of 2.3%.

Moreover, core inflation also came in above economists’ expectations, at 3.3%.

On the other hand, US unemployment insurance filings beat the forecast number by 30,000, having risen to 258,000. This is the largest weekly increase this year, supporting the case for monetary policy easing.

In early trading, the two-year Treasury yield has remained stable, at slightly above 4%.

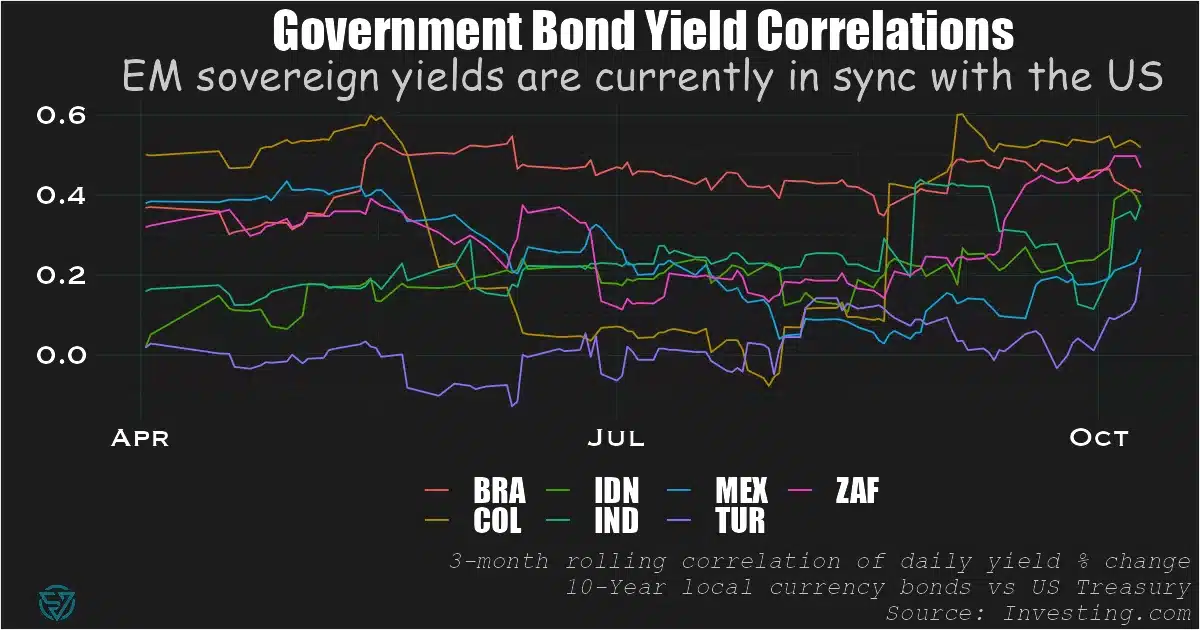

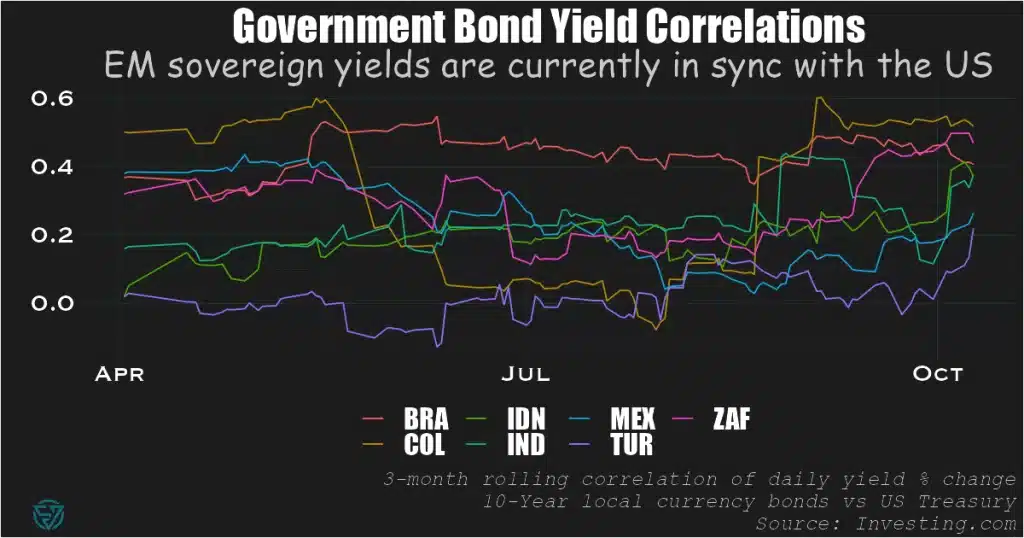

EM and Treasury yields are tightly correlated

Since August, EM sovereign yield correlations to US Treasuries have increased.

Looking at this relationship over a three-month rolling window, this tighter link has benefited EM government issuers.

Indeed, their borrowing costs were declining until end-September, except in the case of Brazil (see first chart above).

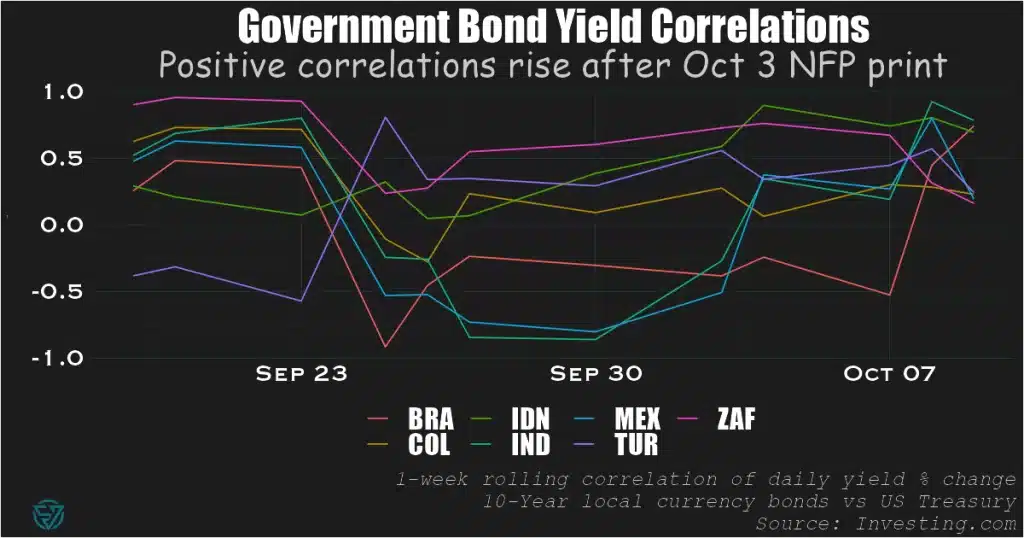

And since October 3’s large NFP figure, all seven in-sample EMs have seen their weekly yield correlations to US Treasuries turn positive.

Moreover, 10-year local currency government bonds in Brazil, India, and Indonesia have recorded positive weekly correlations with 10-year Treasuries of 0.75 or above.