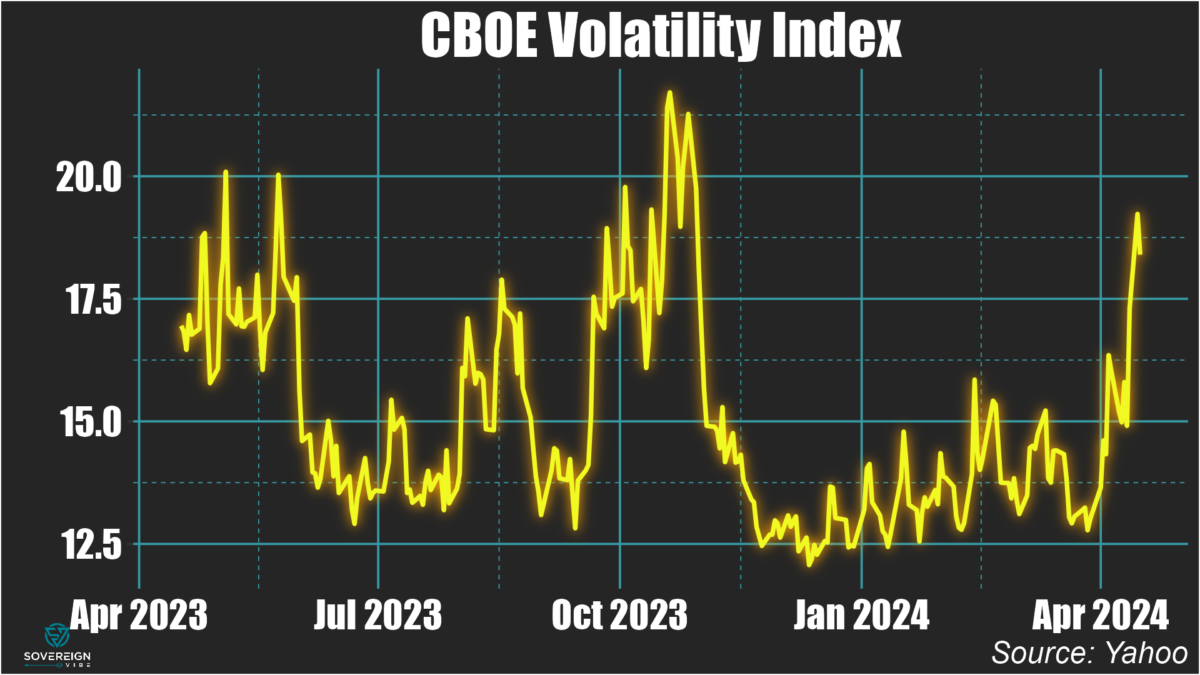

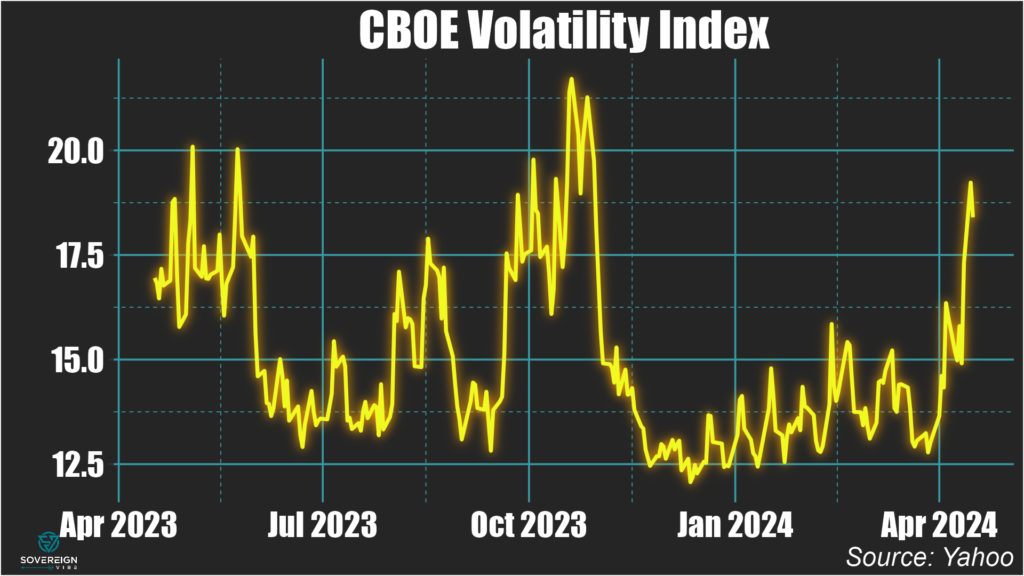

The headline article in yesterday’s FT focused on the “soaring” Vix index, a well-known measure of investor skittishness.

Much ado about VIX

VIX rises when market participants expect more volatility in the S&P 500, as it reflects the cost of buying options used to profit from changes in stock prices.

It’s clear that markets are concerned that interest rates will be higher for longer in the US as the Fed grapples with sticky inflation and by escalating Iran-Israel tensions.

These are the reasons that pushed VIX this week to its highest level since October (see chart). That spike occurred amid investor worries over Hamas’s attack on Israel and before Fed chair Jerome Powell’s dovish end-of-year remarks.

VIX is actually quite low

While it is true that this could mark a turning point for markets, what stands out to me is how low VIX went in December and January. Upbeat sentiment around the Fed lowering rates by June or earlier would certainly have warranted somewhat of a decline.

But Israel’s retaliation against Gaza, Houthi attacks on maritime traffic in the Red Sea, and reversals on the battlefield for Ukraine’s military amid US Congressional delays on aid have punctuated the past several months. These should have dampened investor euphoria more than they did.

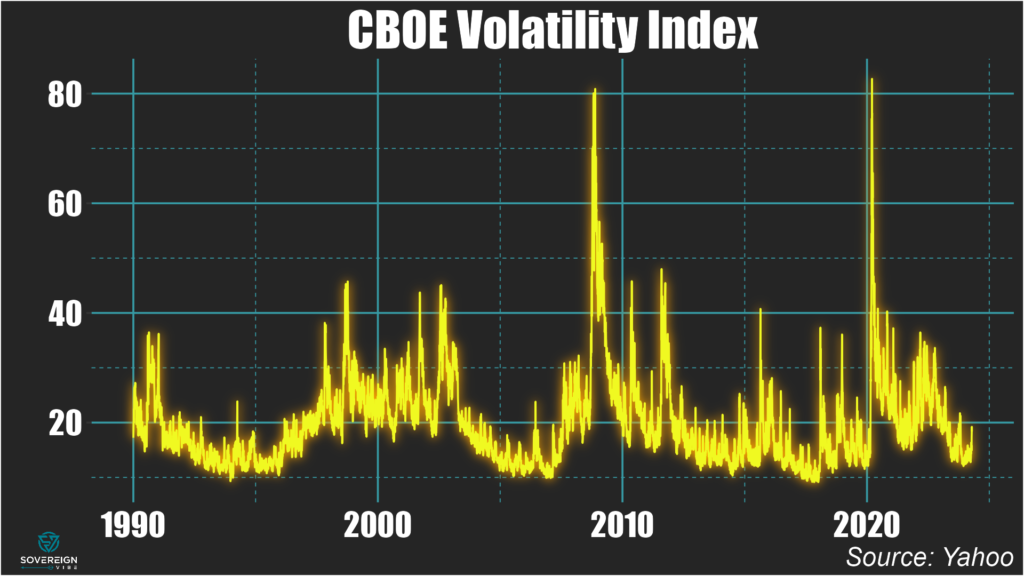

Moreover, taking the long view, VIX isn’t exactly “soaring” (see chart). Perhaps it should be higher than where it currently is, and may well rise.

But, frankly, with the pandemic and the wars in Ukraine and Gaza defining the decade so far, this modest rise in the VIX shouldn’t be at all surprising. This is what I believe is called, in the official parlance, a nothingburger.

As for the supposedly “soaring” VIX, for the FT I have only one question: