Debt management offices in emerging market finance ministries should be prepared for Fed rate cuts.

Emerging market sovereign debt issuance started 2024 off strongly with record-breaking issuance in January at ~$47bn and another ~$16bn in February, marking the highest January-February result since before the pandemic. Sub-Saharan African sovereigns even returned to the Eurobond market, with Côte d’Ivoire leading the way and Benin placing a debut issuance. Larger players including Saudi Arabia, Mexico, Indonesia, Hungary, and Romania made placements as well.

With borrowing costs having immediately fallen in the wake of Federal Reserve Chair Jerome Powell’s dovish comments on US inflation in December, the start-of-the-year timing for issuance was savvy given renewed concerns since March around higher-for-longer interest rates. With the 10-year US Treasury yield having climbed nearly 600bps since early March and the dollar also strengthening, debt management offices have likely become more circumspect regarding US inflation and the Fed.

The fading prospects of US rate cuts before H2 haven’t put a halt to activity this April out of Abu Dhabi and, more absurdly, El Salvador. And other debt management offices, including Tanzania, are also considering Eurobond issuance. Apparently EM sovereigns have issued about $93bn so far this year, which means about $30bn for March-April. These are still big numbers, but nothing close to that fast start in January.

Friday’s US inflation print came in hotter than expected, fueling ongoing concerns that rates will have to stay high for a while yet. The Fed’s preferred metric is core personal consumption expenditures (i.e. ex-food and energy), which rose 2.8% year-over-year in March – a third high monthly reading in a row. But digging through US data shows that the Fed may yet bring inflation lower soon. Looking at the consumer price index provides more granularity than is easily available through PCE, though it measures slightly different things.

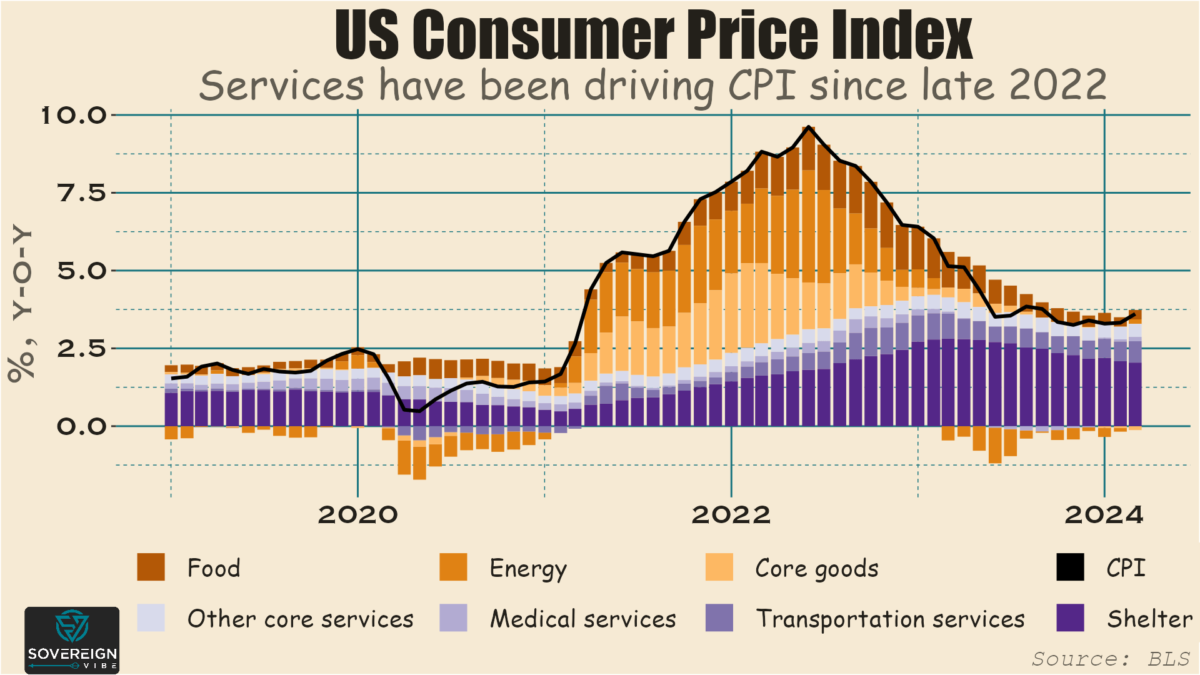

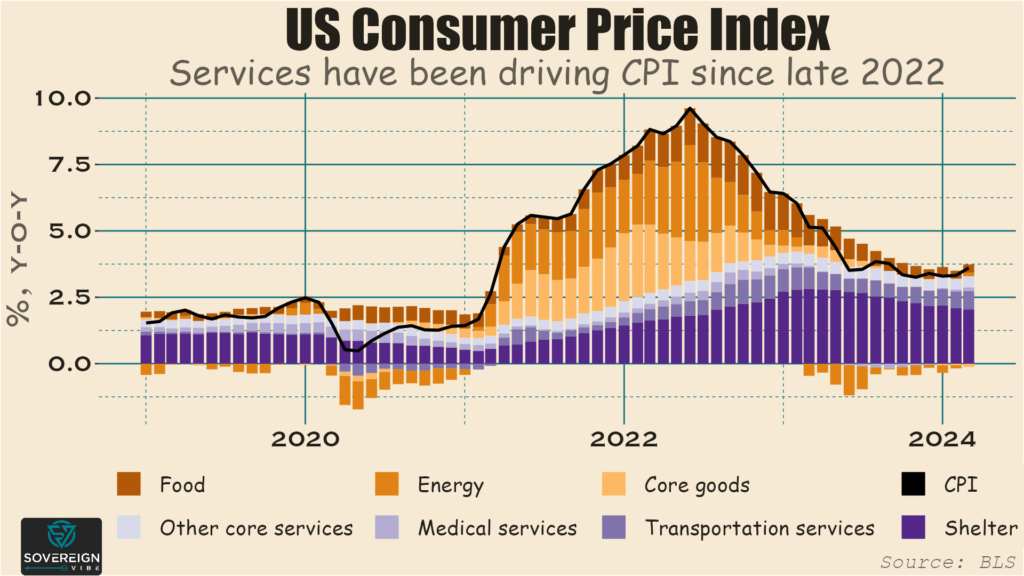

In any case, it’s clear that almost all price pressures are emanating from services, with core (i.e. ex-food and energy) goods inflation having even turned negative. Within services, the largest component is shelter, which is often the case historically as well, but shelter inflation has moderated significantly over the past several months.

The main inflationary challenge is actually in the transportation services segment, which accounts for the lion’s share of services ex-shelter inflation. Within this category, motor vehicle insurance prices have been surging, e.g. 22% y-o-y in March, due to lingering Covid-era supply chain effects, changing car technology, higher car prices, and higher repair costs. It is likely that these factors are now locked in and will not rise much further, if at all. With the high base effect is now baked in, transportation services inflation will almost certainly fade over the coming months.

The upshot is that emerging market DMOs should expect US inflation to moderate over the coming months and for the Fed to cut rates at some point this year – and perhaps sooner rather than later. So I wouldn’t be surprised to see a pick-up in EM issuance again this year, though investor demand may be more for EM IG than for EM HY. Whether it’s wiser to place a Eurobond or a local currency bond, and whether offices should hedge their currency exposure in the former case is another matter. In the meantime, let the roadshows begin?