The recent escalation presents downside market risks, albeit these are limited.

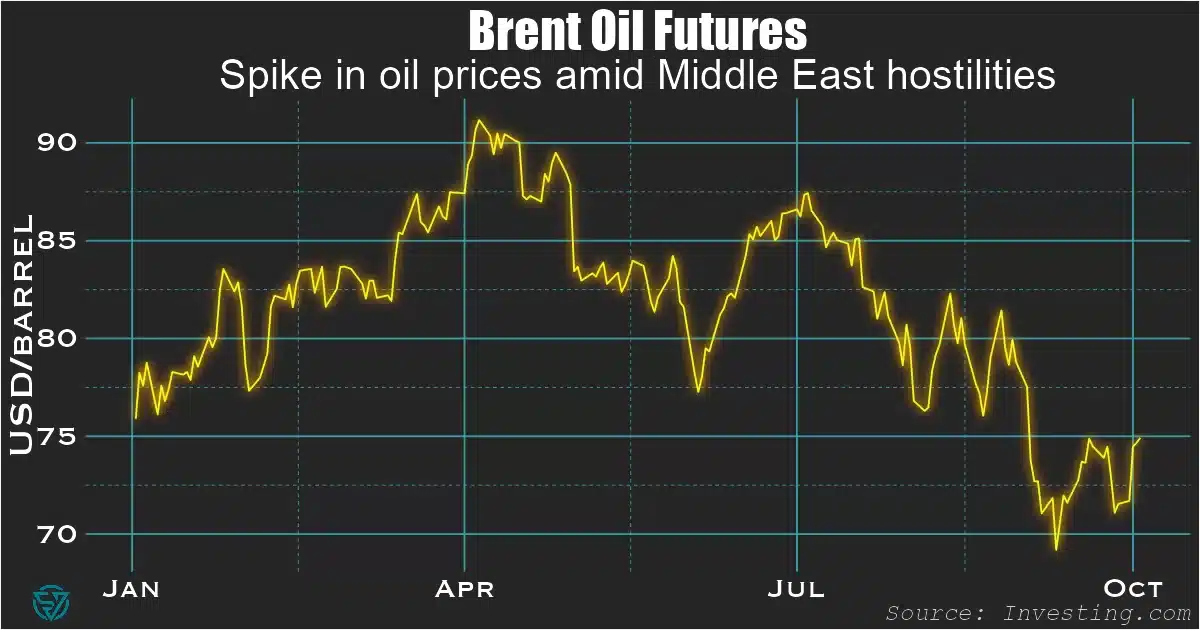

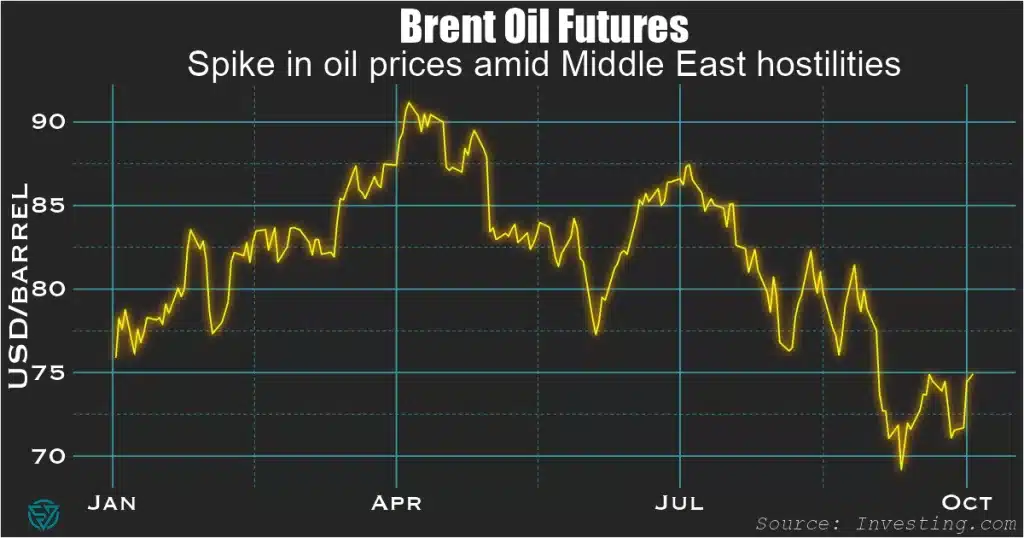

Brent oil prices have risen quickly this week to reach $74.92 per barrel at the time of writing on Thursday, reflecting concerns at potential disruption to Iranian supply.

Market participants see a non-zero chance of Israel targeting Iran’s oil facilities in response to over 180 Iranian missiles fired towards its territory.

April 2024 redux

Today’s situation contrasts with the Iran-Israel missile and drone strikes in mid-April 2024. These didn’t cause oil prices to increase, given Israel’s muted response at the time.

In fact, April prices decreased on the back of slower US business activity and limited concerns over the Middle East.

The difference this time is clearly Netanyahu’s willingness to use a more aggressive approach against Lebanon and Iran, justifying rising prices.

Limited fallout

The conflict has yet to spill over to the broader Persian Gulf, which would be a driver for a larger jump in prices.

In the meantime, OPEC+ cuts to production in recent years have resulted in 5 million barrels per day of excess capacity, which could be restored in case of Iranian supply disruptions.

Although these Middle East tensions have shown some signs of dampening investor risk sentiment over the past week, the effect has been limited.

Over the past week, the S&P500 is down marginally, and the dollar index has strengthened, both of which are consistent with a risk-off mood.

As for other havens, these haven’t moved in a risk-off direction. US Treasury yields are up (on the back of strong payrolls), the yen has weakened, and gold has traded flat.

Stay focused on policy, macro data, and earnings

For all these reasons, investors shouldn’t worry too much about the Israel-Lebanon/Iran disrupting markets much beyond what may be a temporary surge in oil prices.

As is usually the case, monetary and fiscal policy, macroeconomic data releases, and earnings reports will drive market reactions more than politics or geopolitics.

For instance, in the US, jobless claims, Purchasing Managers’ Index reports, services activity data, and the non-farm payrolls report are all due to be released this week.

These will affect markets much more than the Israel-Iran situation, given the need to position around the path of Fed policy in the rate-cutting cycle that began last month.

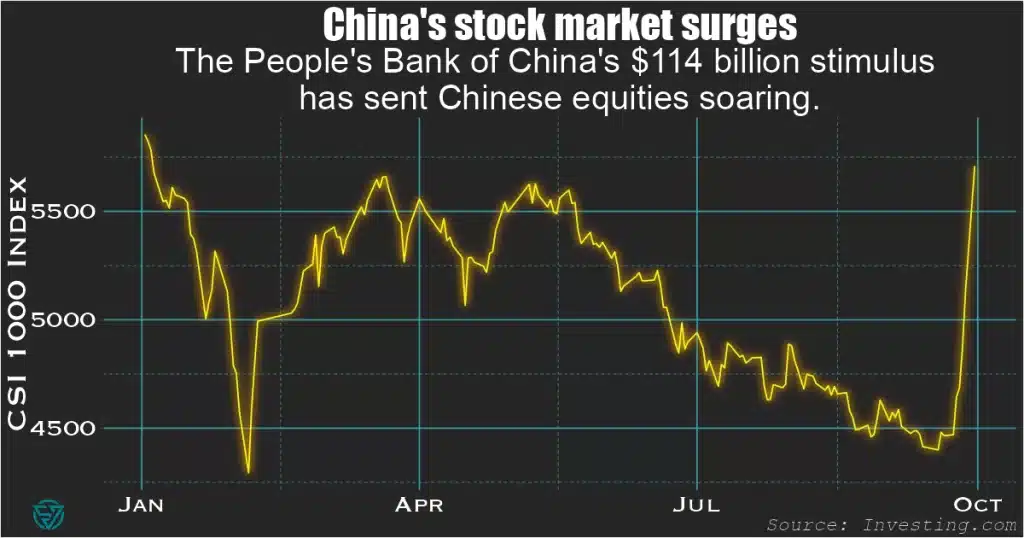

China’s recent stimulus package is another case in point. Last week the People’s Bank of China announced rate cuts on mortgages and reserve requirements, in addition to a $114 billion facility to fund stock purchases.

These are designed to support the distressed real estate market and reverse deflation. Local equity markets reacted with the single largest daily gain since 2008, even though the impact of these measures on earnings is of course yet to be seen.

In any case, the geopolitical tensions around a Japanese destroyer sailing through the Taiwan Strait were barely felt in markets last week despite the China’s fuming response and putting its military on “high alert.”