Building on a previous post on the de-dollarization debate, a snapshot of Russian trade invoicing data gives a sense of a potentially maximum speed of the dollar’s declining use in some quarters of the global economy, while also revealing how Moscow’s trading partners are willing to part with rubles but unwilling to receive them.

As has been widely reported, trade with Russia since the start of the war in Ukraine in February 2022 is being invoiced increasingly in Chinese yuan, at the expense of the dollar and euro. Russian imports in CNY have increased over 8x from January 2022 to June 2023, rising from $1.1bn to $9.1bn over that period. Meanwhile, USD and EUR fell from a combined $17bn to $8.5bn, with the USD experiencing a drop of around 60%.

And while these comparisons exclude seasonal adjustments, the trend is clear, and comparing year-on-year growth readings for June 2023 versus June 2022 tells the same story: CNY: +148%, USD: -57%, EUR: -35%.

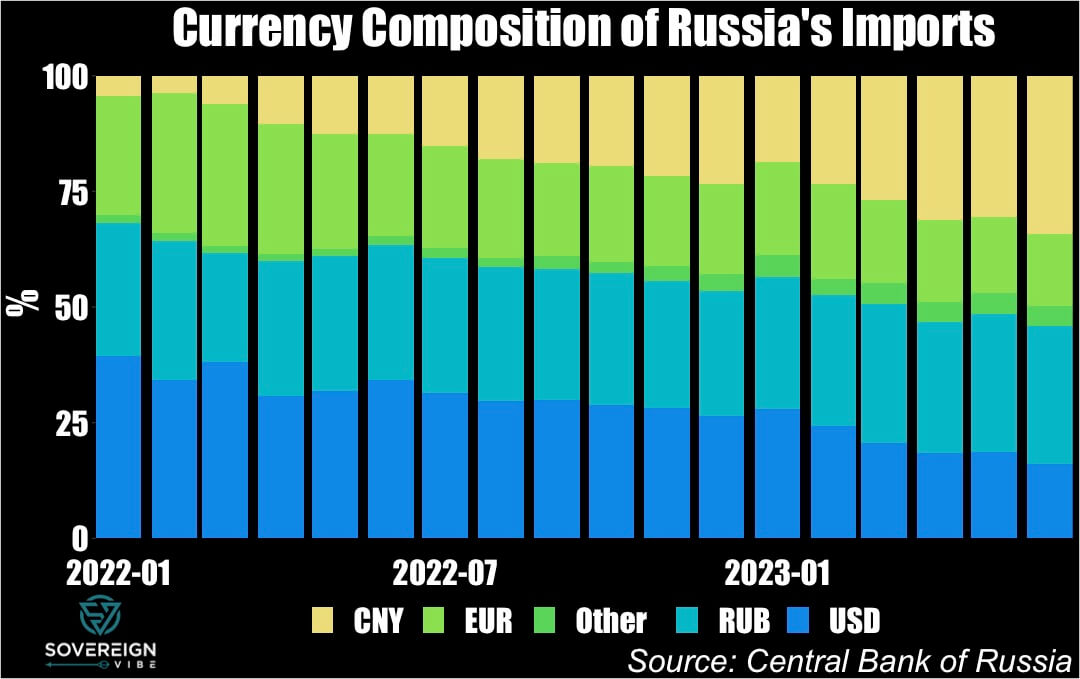

In percentage terms, USD has declined in Russia’s import invoicing from 39% in January 2022 to a mere 16%, while EUR shrank from 26% to 16% as well. That is a combined 33 percentage-point drop for both currencies.

In the same period, CNY’s share rose 30 ppts, from 4% to 34%, almost entirely replacing USD and EUR. Moderate increases in the shares of other currencies and the RUB explain the remainder, though the fact that the RUB has only risen 1 ppt suggests that exporters to Russia are reluctant to accept Moscow’s currency.

Looking at the export side reveals a similar picture. Only $170mn Russian exports were invoiced in CNY back in January 2022, whereas in June 2023 these exceeded $8.1bn. While the USD and EUR each accounted for $25bn and $17bn at the time, these have fallen off to around $7bn and $2bn currently, respectively.

In contrast to Russian imports, where the USD’s decline was more precipitous, it is EUR that had the faster drop in the case of exports, likely due in significant part to the sharp reduction in Russian energy exports to Europe. Another difference is that, unlike Russia’s imports, which have remained somewhat stable over this period, the country’s exports appear to be on a declining trend, pointing to downward pressures on the trade balance.

Staggeringly, CNY now accounts for a quarter of payments that Russia receives for its exports, up from less than half a percent 18 months prior. The USD share is down from over half of all export receipts to some 23%, while the EUR has decreased from 35% to 7%.

Surprisingly, RUB has increased markedly, from 12% to 42%, though this makes good sense if one considers that foreign buyers are likely keen to reduce any long exposures they may have to the ruble. Such positioning currently appears to prescient, given the RUB’s significant weakening to ~100/USD at the time of writing.

Future posts will explore the implications for the dollar’s role and the bigger question of using frozen Russian assets for the reconstruction of Ukraine.

One reply on “Russia’s trading partners steer clear of rubles”

[…] world has now entered a new period in which countries are reconfiguring their trading relationships and supply chains in reaction to heightened geopolitical tensions, […]