High economic-political uncertainty paired with low volatility amplifies market risks

In its recently-released Global Financial Stability Report, the IMF warns that the disconnect between rising economic and geopolitical uncertainty and low financial volatility increases market risks.

The CBOE Volatility Index – a barometer of equity market volatility – has remained at or below 20 for much of 2024.

The IMF’s warning is in keeping with an April 2024 edition of this newsletter, “Are markets underpricing geopolitical risks?”

August volatility

The sole exception to this low volatility occurred in early August, when the Bank of Japan spooked markets with an unexpected interest rate hike.

This surprise unwound massive carry trade positions from the yen into assets denominated in emerging market currencies, causing the VIX to surge.

Carry trades involve borrowing in a low-interest rate currency to invest in a high-interest rate currency.

Threats to lofty valuations

This year credit and equity markets have remained strong despite slowing earnings growth and rising fragilities in parts of the corporate and commercial real estate sectors.

Amid already-lofty valuations, there are concerns that, as many central banks pursue their easing cycles, interest rate cuts could lead to asset bubbles and rises in private and government debt and non-bank leverage.

The Fund underscores the uncertainties around military conflicts and the future policies of newly elected governments – in a nod to the many elections in 2024, including in the U.S.

Yet this year only a monetary policy event – i.e. the BoJ-carry trade de-leveraging – has caused volatility to rise, rather than any military or political factors.

While some military or political factors could roil markets, economic policy surprises and threats to corporate and household resilience could just as easily cause volatility to surge.

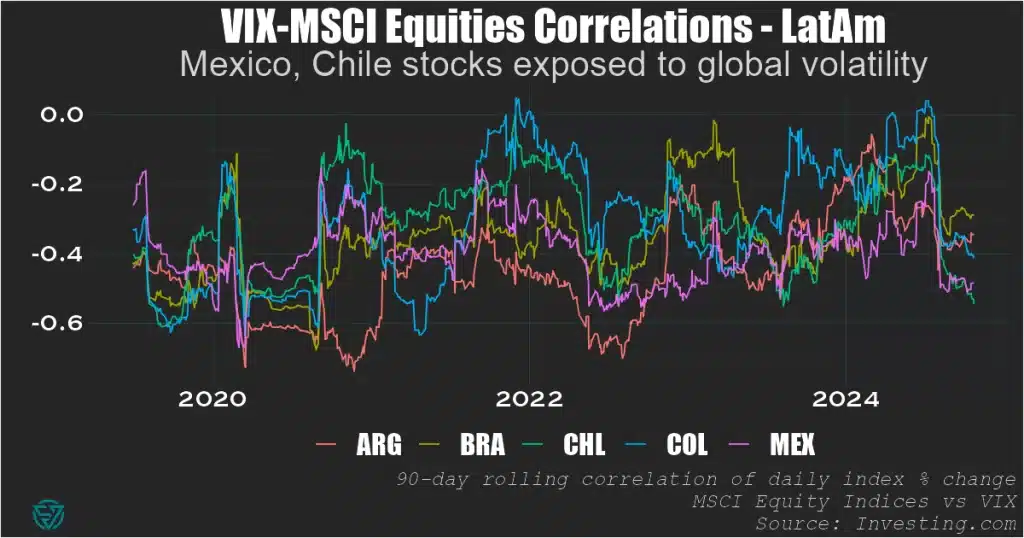

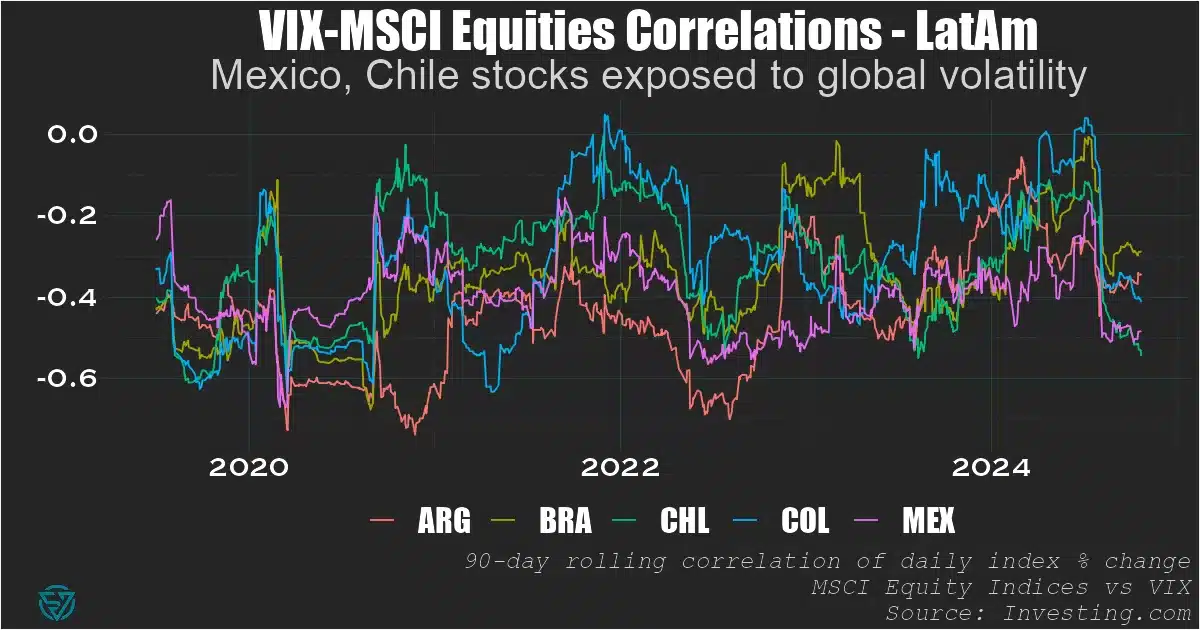

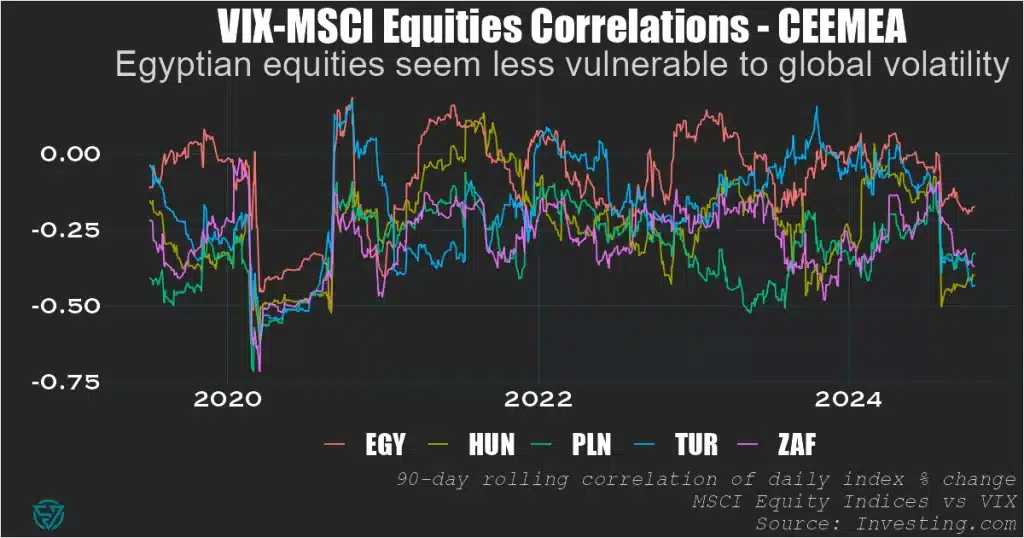

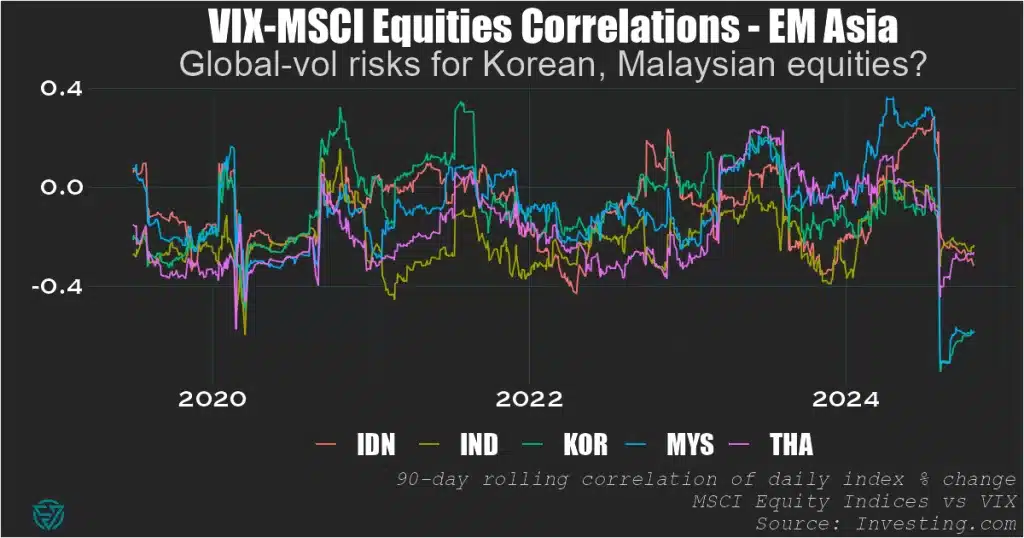

VIX-equity market correlations

Regardless of what causes equity market volatility, seeing how emerging country equity markets are correlated with VIX yields some clues as to which countries are more vulnerable.

To do this, I compare daily changes in VIX to daily MSCI index returns and smooth that data out over a 90-day period.

These VIX-MSCI correlations are generally negative, as expected, meaning that a rise in volatility is associated with a decline in daily returns.

The relationships are naturally dynamic over time, given the presence of idiosyncratic market drivers in each country and the varying sources of global market volatility.

CEEMEA

Looking across the three EM regions, in CEEMEA Egypt currently appears less negatively-correlated – and therefore less vulnerable – to VIX.

In all five countries, the negative VIX correlations dropped to nearly -0.75 during the first wave of the pandemic in H1 2020, underscoring the risk to EMs from global vol.

EM Asia

In EM Asia, Korean and Malaysian equity markets appear most at risk from changes in VIX.

We can’t really ascribe it solely to them being small, open economies, as their VIX correlations aren’t systematically more negative than their larger regional peers.

But certainly something about the current environment – whether global or local – is causing these correlations to be at -0.6, which points to significant VIX vulnerability.

LatAm

As for LatAm, Mexico and Chile stocks are most exposed to global vol.

Their equity market correlations with volatility are around -0.5, meaning they seem to face less VIX risk than Malaysia or Korea but more than any of the CEEMEA countries.