Berkeley-based economist and titan of the profession Barry Eichengreen notes that the dollar’s reserve currency status is continuing to erode in favor of “non-traditional reserve currencies”. But looking closely at the same recently-released IMF data through Q4 2023 paints a more nuanced picture.

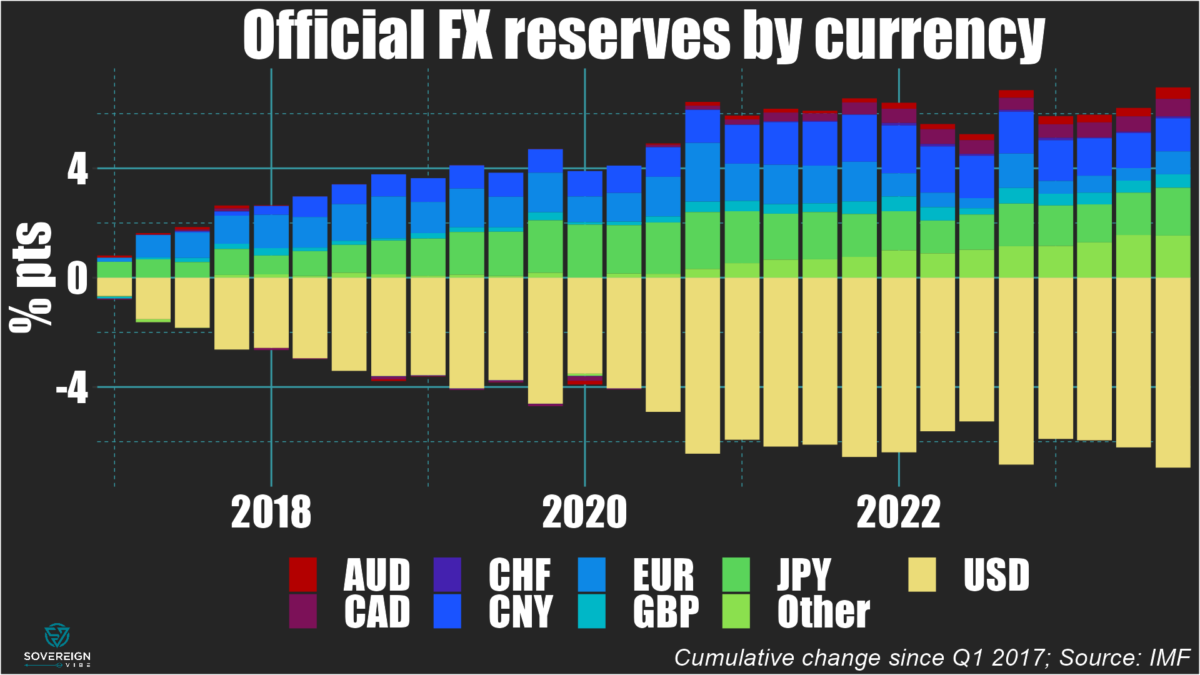

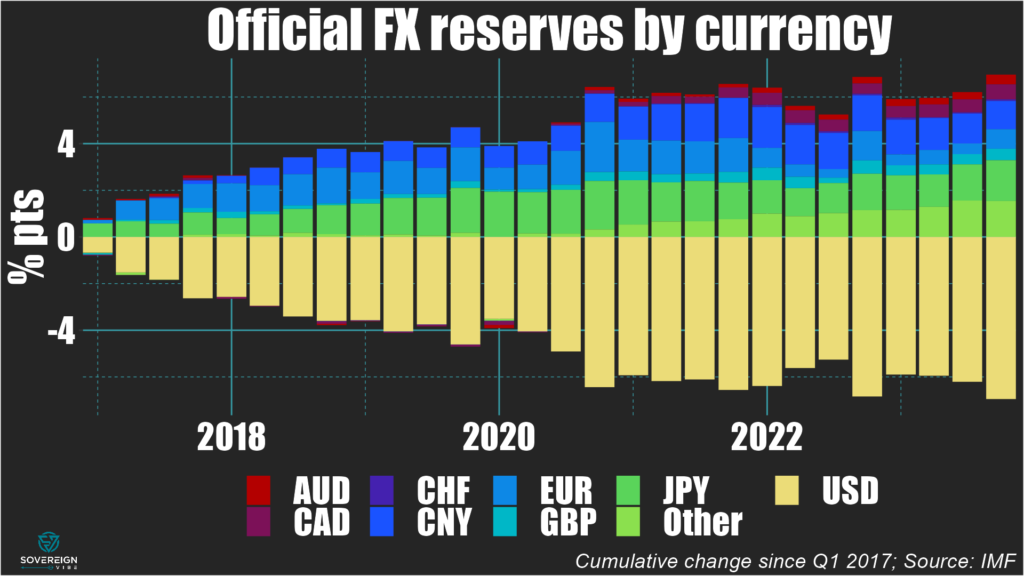

At end-2016, the IMF reclassified yuan holdings from “other” to its own explicit category, so I’ve calculated cumulative changes from Q1 2017 onwards:

- While the USD’s share in international reserves holdings have dropped by about 7 percentage points since then…

- …the biggest beneficiary is neither the yuan nor “other” currencies…

- …but in fact the yen.

- The yuan has increased its share by about 1 percentage point…

- …but the euro, pound, and Australian & Canadian dollars have seen their shares increase as well, for a combined total of over 2 percentage points.

So the shift away from the dollar is just as much – if not more – about a rotation into G7+ currencies as it is towards the yuan and other non-traditional reserve currencies. I’ve written previously about how a sizable chunk of Russia’s reserves have been held in Japan and how GBP, AUD, and CAD have been eating up some of the USD’s share.