Looking across the emerging markets complex, Turkey stands out as one of the larger, systemic EMs that is rapidly headed in the wrong direction. Inflation has of course been the main symptom of imbalances in the economy, gyrating between 40-80% since 2022. It currently stands at around 70%, despite the central bank hiking the policy rate from 45% to 50% in March.

Part of the reason behind rampant inflation is an ongoing credit boom in the country. Private firms and households account for much of the borrowing, with worryingly strong growth in credit card debt. Lenders are issuing more debt in foreign currency, which increases currency risks. Non-performing loans remain low, but the central bank has tightened macroprudential regulations in response to this recent credit growth.

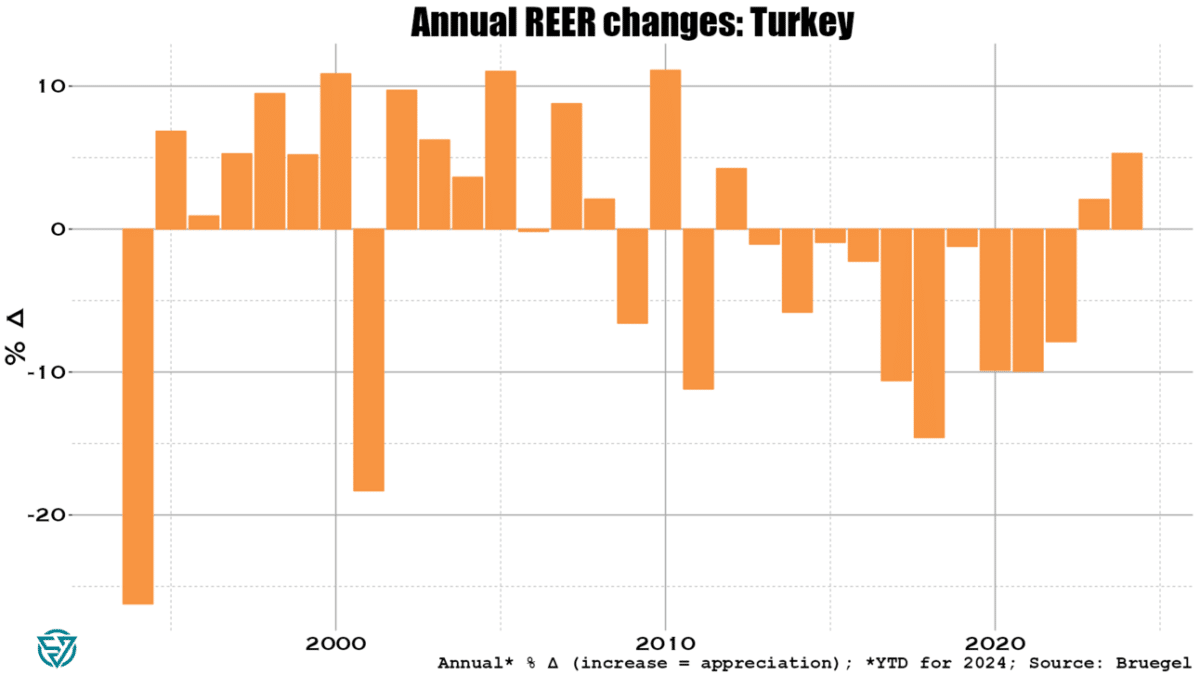

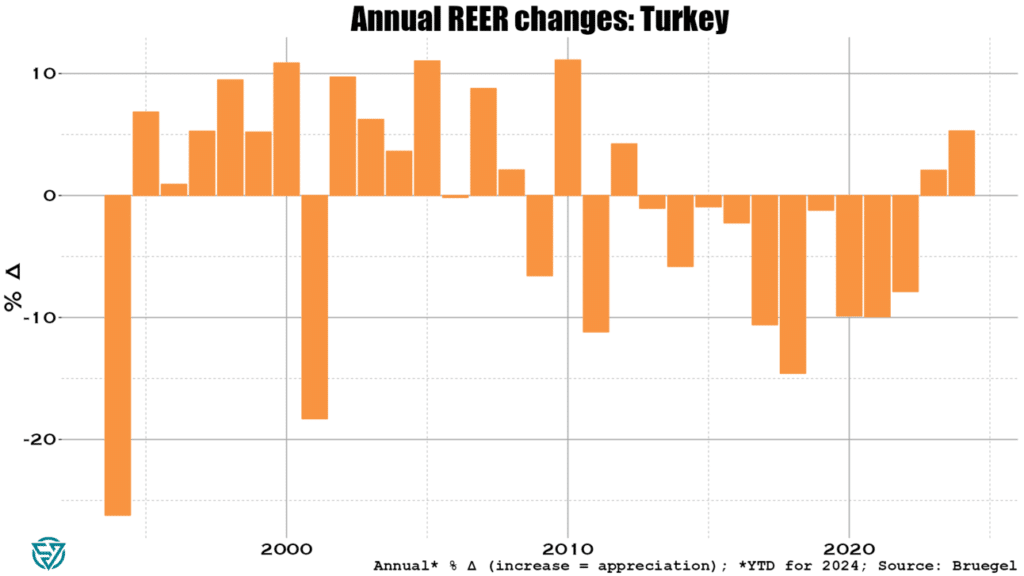

At above 33 to the dollar, the lira is at record lows. Even so, Turkish export competitiveness is eroding as the real exchange rate with trading partners has surged by more than 5% YTD through end-May.

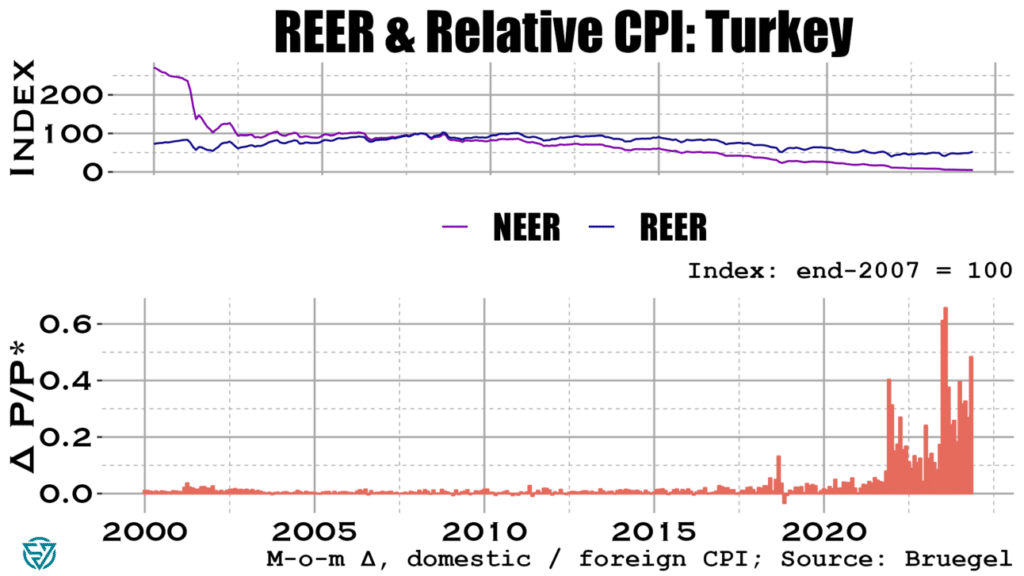

With the lira tanking, inflation is of course driving real exchange rate appreciation. Prices have been rising much faster in Turkey than has been the case with its trading partners in 2023 and 2024.

It seems that so far Turkey has had somewhat of a reprieve from these brewing imbalances. Not only does loan performance remain decent, but the current account deficit was “unusually” small in May. The carry trade is driving surging portfolio and bank flows to Turkey, which has driven official reserves to increase to $148 billion in June.

Still, Turkish foreign exchange reserves are low compared to EM peers. They currently stand at 13.3% of (2023) GDP. While an improvement since last year, that’s still only 4.9 months of imports.

So it’s certainly worth keeping an eye on increases in the country’s external financing needs. An increase in the current account deficit and/or an abrupt halt to the carry trade flows linked to further worries over lira weakening could see the central bank dip into its reserves to cover gaps. Watch this space.