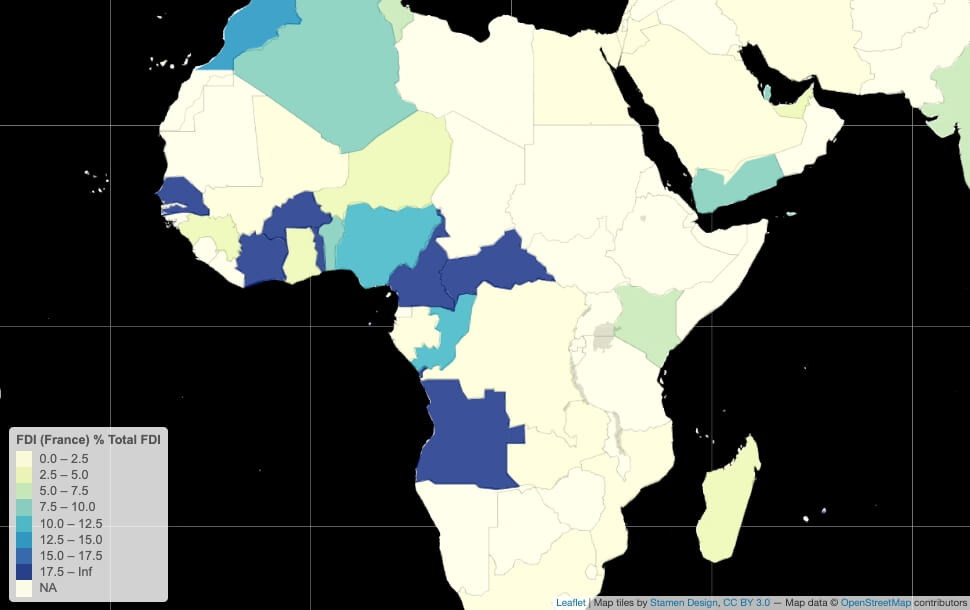

The recent wave of coups in Africa has increased scrutiny of France’s role on the continent. Looking at France’s net stocks of foreign direct investment in its former colonies reveals some surprises for those not closely monitoring these trends, and helps provide some sense of where Paris’s relations are with this group of countries. A snapshot of Franco-African economic relations helps debunk the oft-exaggerated importance of French influence in Africa, despite it being too early for a Françafrique post-mortem. Using foreign direct investment as a proxy delivers useful context for observers wondering where the next coup might strike, not as a causal factor, but as an illustration of heterogeneity.

As a percentage of all FDI in Sub-Saharan Africa by country, France is best represented in Senegal, Côte d’Ivoire, Burkina Faso, Togo, the Republic of Congo, Cameroon, and Angola. Of these countries, only Burkina Faso has experienced a coup d’Etat in recent years. French FDI as a percentage of GDP is highest in Senegal, the Congo, the Central African Republic, and Angola, and was also significant in Niger in the mid-2010s. The point is that the French factor, especially in the economic sphere, fails to shed much light on why any of the coups in Gabon, Niger, Chad, Burkina Faso, Mali, and Guinea occurred, each of which has its own idiosyncratic explanations.

Coup’s next?

As for the prospects of further military takeovers in Africa’s Sub-Saharan francosphere, Senegal and Congo appear the least likely candidates. In Senegal, President Macky Sall is not seeking an unconstitutional third term in the 2024 election, in keeping with the country’s history of political stability. In Congo, President Denis Sassou-Nguesso’s apparently ironclad grip on the country has shown no signs of wavering. In Cameroon, President Paul Biya’s late August military reshuffle could offer him some temporary protection, though the ongoing conflict with separatist rebels in its anglophone region is a source of risk.

None of the countries in the Sahel are completely immune from another putsch. In Chad, Mahamat Idriss Déby Itno’s future will depend on his ability to exercise control to the same degree as his father, the previous president. In Burkina Faso, 34-year-old Captain Ibrahim Traoré has already done well to last a full 12 months, while in Mali the Touaregs are a perennial thorn in Bamako’s side. Facing no credible threat of foreign intervention, Niger appears to be under tight control – for now.

Côte d’Ivoire’s 2025 presidential election is an upcoming flashpoint in an ethnic powder-keg, with President Alassane Ouattara already having changed the constitution to enable a third term from 2020. Since the International Criminal Court in the Hague acquitted former president Laurent Gbagbo of all charges in 2019, it’s a politically-explosive resurrection given the context of ongoing ethnic favoritism in Ivorian politics. To complicate matters further, the largest of the country’s three main ethnicities – Ouattara and Gbagbo hailing from the other two – hasn’t held the presidency since 1999, setting the stage for further grievances.

France FDI timelines

The charts below present a snapshot of how France’s FDI presence has evolved in select Central and West African countries, where Paris is regarded as having the most influence in Sub-Saharan Africa. As can be seen from the map above, its FDI presence is weaker in East and Southern Africa, even where it once had a colonial presence (e.g. Madagascar, Comoros, Djibouti). The high-level overviews presented below focus only on broad aspects of France’s investment footprint in these countries and often overlook the activities of French groups with a pan-African presence, including Total, Bolloré Africa Logistics, Air Liquide, CMA CGM, and Castel, among many others.

Central Africa

With all eyes on Libreville following Gabon’s August coup, facile narratives of France’s relevance are overblown, historical, linguistic, and security ties notwithstanding. France’s FDI involvement in GDP terms was higher in Gabon than in any other Central African country at one point in the mid-2000s, though Congo has had more French investment stock as a share of its economy for most of this century. In dollars, however, Angola has attracted the largest quantity of French investment.

Gabon’s main economic drivers are the oil, manganese, and wood sectors, with a French presence in each of these and well beyond. The French oil major Total has ongoing but diminished activities, following its sale of some of its Gabonese assets to the Anglo-French oil company Perenco in 2021. The Euronext-listed metallurgical and mining company Eramet continues to operate the country’s chief manganese concessions, while the Rougier group is a significant wood processor and exporter.

Yet Gabon’s economic partnerships have been tilting away from France for over a decade. Singapore has been a major player in the country since the agri-business company Olam entered into a joint venture with the government in 2010 to create a Special Economic Zone. The Paris-listed oil junior Maurel & Prom continues to operate in Gabon but has been majority-controlled by the Indonesian state oil company Pertamina since 2017. In 2022, Gabon joined the Commonwealth, alongside Togo, another former French colony, even as Libreville’s trading relationships shifted away from France and towards Asian partners.

France is a leading foreign investor in Angola, accounting for 60 subsidiaries and 45 local companies that employ around 10,000 people – trailing only Portugal and China on this metric. France has benefited from President João Lourenço’s efforts to rebalance economic ties away from Chinese, Russian, and Turkish interests in favor of Western partners. The French presence is concentrated in the oil and oil services sectors, with Total, Maurel & Prom, and Technip among the major players. Total alone accounts for 40% of Angola’s national oil production and is one of the country’s largest employers, alongside the French brewer Castel.

Total’s presence accounts for a large share of France’s FDI footprint in the Republic of Congo, where most French companies operate in the oil services and construction sectors. French firms currently employ around 15,000 people, though this is down from over 25,000 in 2015. Italy, the US, and China are the other main foreign investors in the country.

West Africa

Côte d’Ivoire accounts for France’s highest stock of FDI in francophone West Africa, followed closely by Senegal. The latter being the smaller economy of the two, France’s presence in Senegal is heavier in GDP terms. There was also a strong French economic presence in Niger in the mid-2010s, according to the data from the Banque de France below, though this has fallen off sharply in recent years.

France is the largest foreign investor in Côte d’Ivoire, with around 240 subsidiaries and some 1,000 companies owned by French citizens. These investments are spread across numerous economic sectors, reflecting the highly-diversified nature of the Ivorian economy.

France also has the highest proportion of foreign investment in Senegal, though its share has declined markedly since the mid-2010s. This involvement is also spread broadly across economic sectors, including banking, retail, telecoms, and industrials.

In Niger, China, France, and Nigeria comprise the main foreign investors, with a focus on extractive and manufacturing industries. French FDI peaked in the mid-2010s amid rail infrastructure investments by the Bolloré logistics group, road investments by the uranium miner Orano, and uranium transport investments by the Necotrans/R Logistic group.