- FX fair value estimates for 13 economies across CEEMEA at end-2023 underscore the impact of the war in Ukraine.

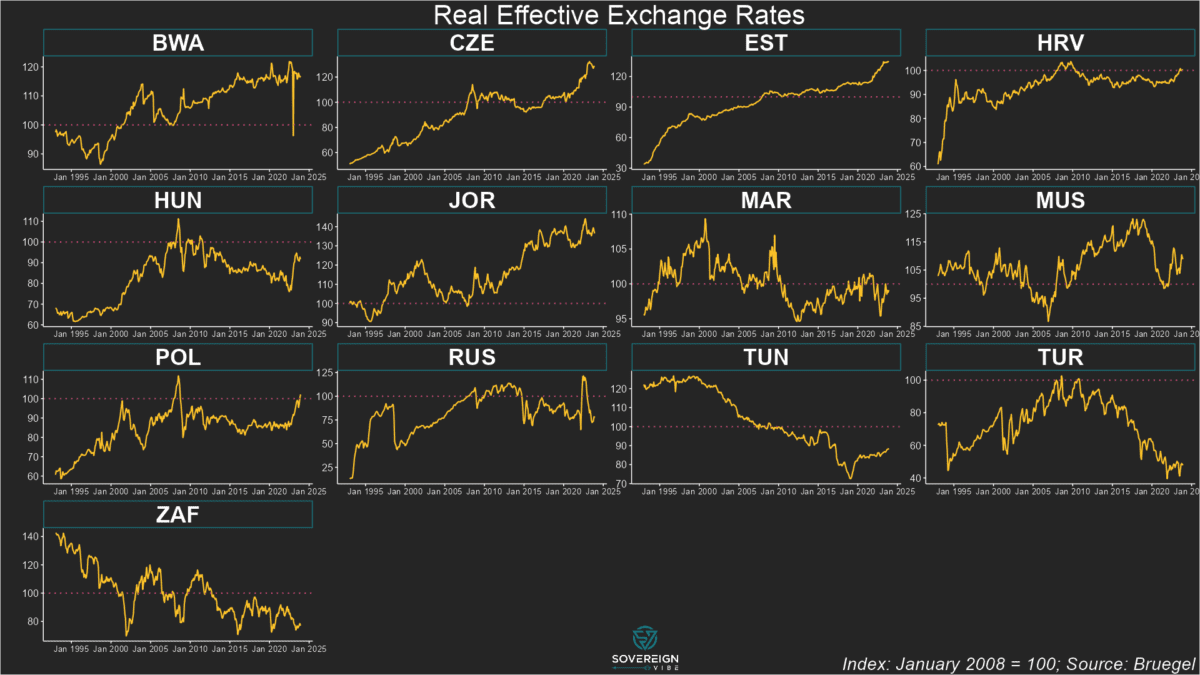

- Real effective exchange rates spiked in various countries following the successive pandemic-Ukraine shocks…

- …although Morocco and Croatia appear to be bastions of REER stability in an otherwise volatile group.

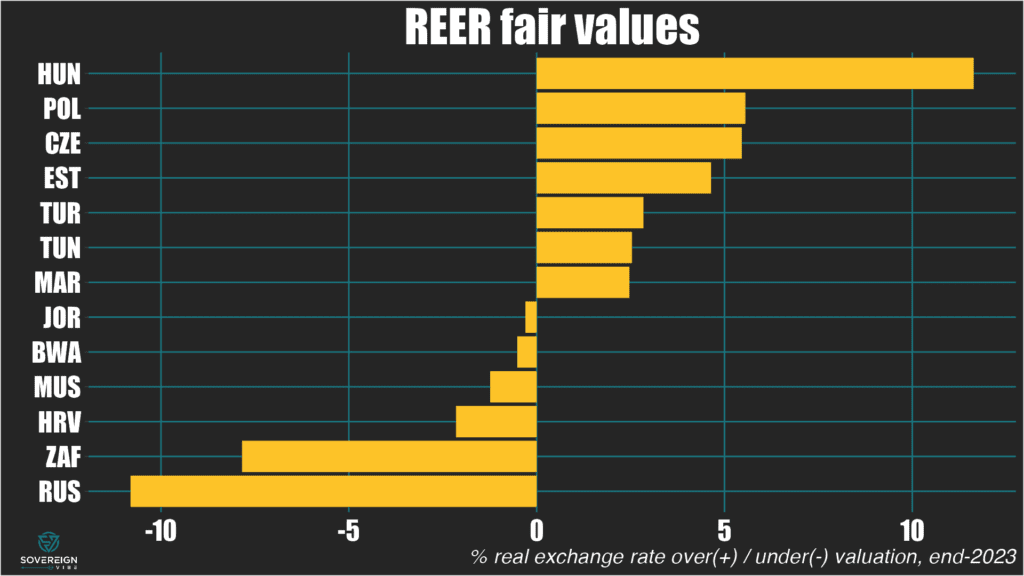

One way to value a currency is to assess the link between current account balances and real effective exchange rates, which merge the nominal exchange rate with the ratio of domestic to trade-weighted foreign prices. The IMF uses a fair value model that compares “equilibrium” to “underlying” CABs, with any difference a result of REER misalignment. FX fair values are presented below.

REER trends in CEEMEA

Several economies in Central & Eastern Europe, the Middle East, and Africa have experienced real exchange rate appreciation in the past few years. The dual pandemic-Ukraine inflationary shock since 2021-2022 is in large part responsible for this: annualized inflation remained in double digits in the Czech Republic, Hungary, Poland, Estonia, and Croatia until early- to mid-2023.

Moreover, the Czech koruna, Hungarian forint, and Polish złoty all weakened significantly in nominal terms in 2022, but inflation was so strong that these REERs still rose that year. In 2023, REERs in these countries continued to climb while the koruna traded flat and the forint and złoty registered modest nominal gains.

Russia saw yearly inflation fall from ~11% at the beginning of 2023 to the 2-3% range in Q2 before rising to ~7% by year end, while the ruble weakened significantly, resulting in REER weakening.

South Africa experienced declining inflation and a minor depreciation of the rand in 2023, albeit on the back of significant currency weakening since mid-2021, causing the REER to slide.

Turkey remains an inflationary basket-case, having spent almost all of 2023 near or above 50% in annualized terms, resulting in the lira’s ongoing decline. The net effect has been for its REER to move sideways – but after many years of secular decline.

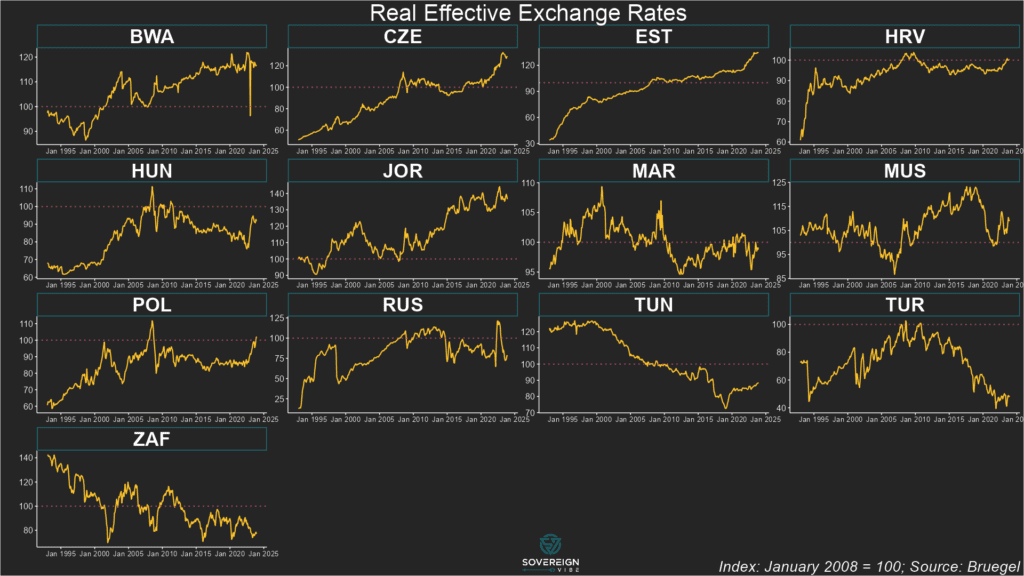

Turning now to fair values, a number of REERs in CEEMEA exhibit significant over- or under-valuation.

Fair Value REERs

In CEEMEA, Hungary, Poland, and the Czech Republic appear most overvalued, while Russia and South Africa seem most undervalued.

It should come as no surprise that Hungary’s REER is overvalued, on the back of high inflation and (very modest) forint strengthening last year. But the real driver is that Hungary is running a massive underlying current account deficit at -15% GDP (see chart below).

Similarly, it also makes sense for Russia to be undervalued given the weaker ruble and moderating inflation. Its underlying CAB being above its equilibrium CAB confirms this is the case.

The same reasoning applies to South Africa: depreciated rand, lower inflation, and underlying above equilibrium.

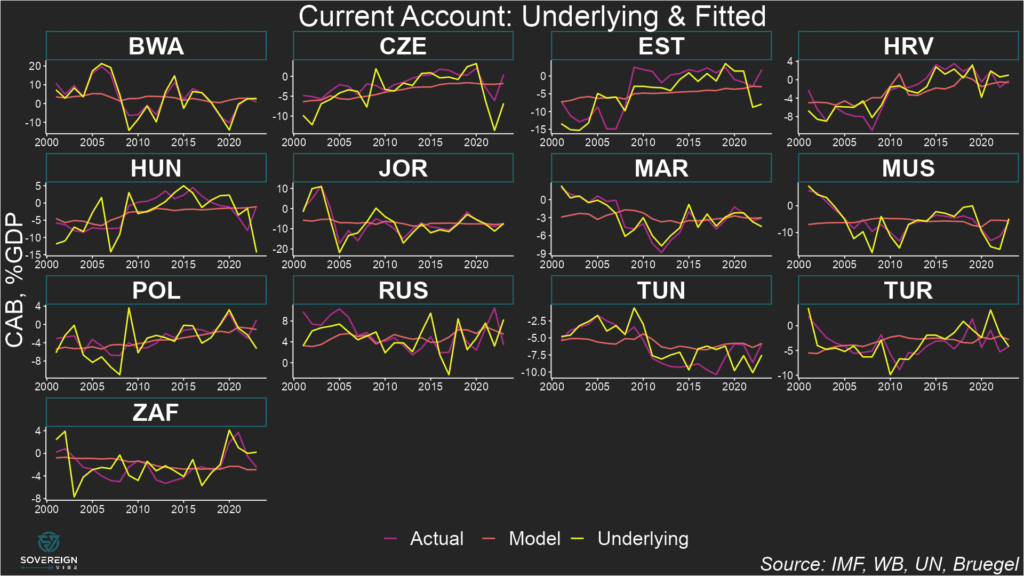

Underlying & Equilibrium CABs

When the underlying and equilibrium current account balances are equal, the real effective exchange rate is at fair value.

If the equilibrium CAB is above (below) the underlying CAB, then the REER is over- (under-) valued.

In the chart below, the fitted estimates of current account equilibria are labeled as “model” and are shown alongside actual and underlying CAB readings.

Countries with high ratios of imports and exports as a share of GDP have CABs that are more sensitive to REER misalignment. Turkey and Tunisia provide an example of different sensitivities. In the chart, in 2023 both look overvalued, as equilibrium is above the underlying CABs.

The gap between Turkey’s equilibrium and underlying CAB is smaller than that of Tunisia, yet Turkey’s REER is more overvalued than Tunisia’s, as depicted in the fair values chart above. This is because Turkey’s economy is more open than Tunisia’s, hence REER misalignment has a greater impact on its CAB.