With global public debt at $100 trillion, many countries need more IMF-World Bank help.

Now that the dust has settled over last week’s IMF-World Bank Annual Meetings here in Washington, D.C., I can’t help but feel underwhelmed.

The meetings have achieved only incremental progress at a time when bold measures are needed to foster growth, eradicate poverty, and achieve the United Nations’ Sustainable Development Goals.

Outcomes

Some of the Meetings’ chief outcomes include:

- The IMF Executive Board has reformed the charges, surcharges, and commitment fees that will lower the cost of borrowing for member countries by some $1.2 billion annually.

- The G20 finance ministers and central bank governors have committed to a roadmap for building larger multilateral development banks.

- The IMF has introduced a new “debt-at-risk” framework that assesses how changing economic, financial, and political conditions can alter the distribution of debt-to-GDP ratios in the future.

- The prospects of providing the International Development Association with a record $100 billion replenishment later this year remain uncertain, amid competing policy visions and domestic fiscal pressures for donors.

Heavy debt burdens

I am far from the only participant who has been left nonplussed by the world’s premier global economic event.

None other than the U.S. Treasury is now pressuring the World Bank, IMF, and other international financial institutions to do more to help poor countries manage heavy debt burdens and handle punishing debt repayments over the next few years.

Global public debt now stands at around $100 trillion, with debt ratios having grown significantly in developing economies.

In 2013, only 6 African countries had debt-to-GDP ratios above 60%, whereas that figure has now risen to 27.

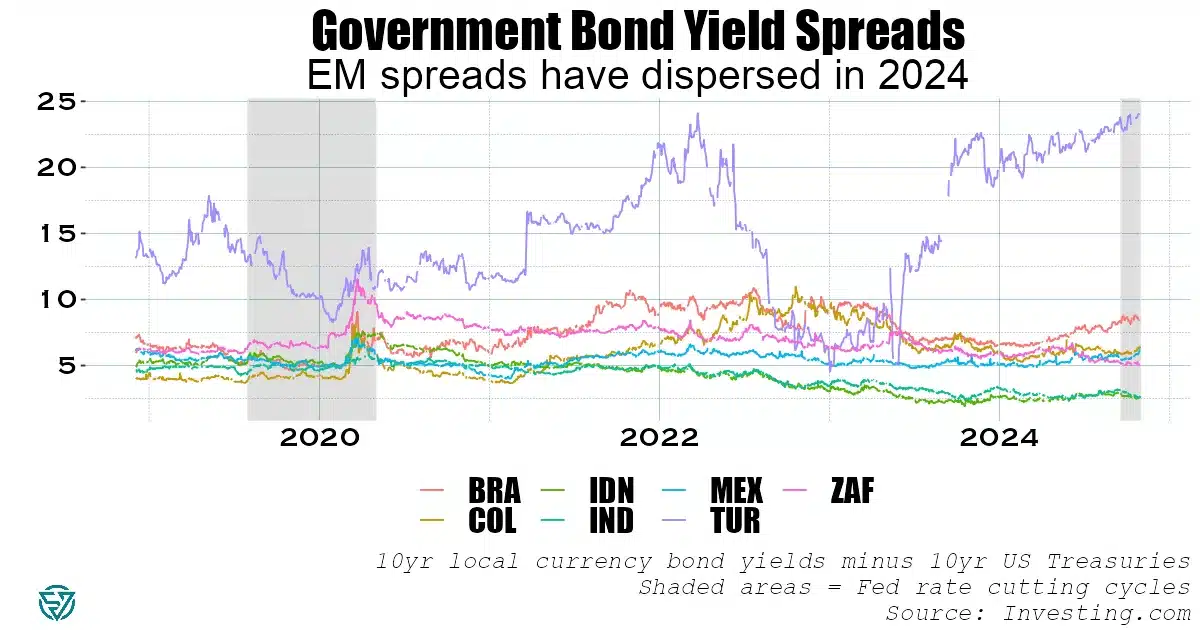

EM local currency sovereign spreads

The payment pressures that EM government borrowers face are real, both for low- and middle-income countries, though relief may come through the recently-begun Fed interest rate-cutting cycle.

Local currency bond spreads over U.S. Treasuries underscore the divergences in borrowing costs in the EM universe, while also reflecting domestic capital market development.

Spreads on Indian and Indonesian 10-year local currency bonds have declined significantly in recent years, to only 250 basis points, on the back of robust growth and sound economic policy.

Turkey has been grappling with inflation above 50%, hence the large nominal borrowing costs in lira.

Similarly, spreads on Brazilian 10-year sovereign bonds are also elevated this year amid perceptions of fiscal risks.

The same has been true in 2024 for Mexico, albeit to a lesser degree, as investors worry over the new Sheinbaum administration’s left-wing spending plans.

South African spreads have declined following the June election that brought the ruling African National Congress into a coalition with the center-right, market-friendly Democratic Alliance party.