This post follows on from previous credit gap analysis on this blog and how this indicator helps estimate the probability of sovereign debt strains, for which Bank of International Settlements data is of great use. However, the BIS data covers “only” 43 countries and the Euro Area, which roughly corresponds to the G20 – including the 27 European Union members. As a result of this limitation, I use World Bank data, which has much broader country coverage, to derive credit gaps for a larger number of countries. As the Bank’s dataset is released on an annual frequency, I use annualized BIS data for comparative purposes, though the latter has the advantage of being published on a quarterly basis and is thus already available for a part of 2023.1As a reminder, in the IMF’s MAC DSA model published in 2021, the coefficient for credit gaps as an independent variable is positive with respect to the dependent variable, which is the probability of a sovereign stress event.

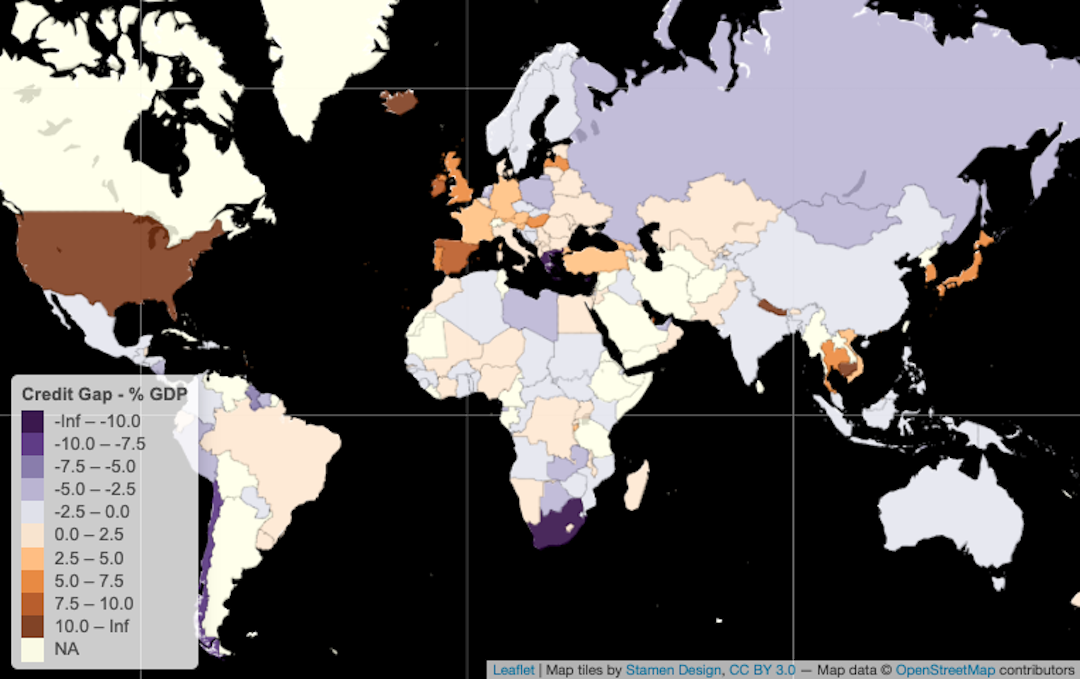

The first map below presents the BIS data on credit gaps in 2022, revealing how most of these 43 countries,2Argentina, Australia, Brazil, Canada, China, Chile, Colombia, Denmark, Ireland, Austria, Czechia, Finland, France, Germany, Greece, Hungary, India, Israel, Italy, Japan, South Korea, Mexico, Malaysia, Belgium, Hong Kong SAR, China, Luxembourg, Netherlands, Norway, New Zealand, Poland, Portugal, Russia, Saudi Arabia, South Africa, Singapore, Spain, Sweden, Switzerland, Thailand, Turkey, United Kingdom, United States, Indonesia are in negative territory, meaning that credit extended to the private sector is below trend. This makes sense given the wave of central bank tightening from circa 2021 in many countries, leading to tighter financial conditions globally. Notable exceptions remained in 2022, including Japan, Switzerland, Germany, and France in the DM space and Korea, Thailand, Indonesia, Brazil, and Hungary among EMs.

The second map shows BIS credit gap data for 2021, when there was clearly more heat in the system. Several countries exhibited positive gaps that ended up turning negative in 2022: Canada, the US, Mexico, Colombia, Argentina, Saudi Arabia, Norway, Sweden, and Austria among them. Virtually all countries cooled down from 2021 to 2022, according to this data.

The credit gaps derived from World Bank data feature in the two maps below, the first of which is for 2022. Sadly, this first World Bank map appears underwhelming given missing 2022 data for a number of large countries, including the US, Canada, Russia, and India. However, the data here covers 101 countries3Antigua & Barbuda, Algeria, Azerbaijan, Albania, Armenia, Angola, Australia, Barbados, Bangladesh, Belize, Bosnia & Herzegovina, Benin, Solomon Islands, Brazil, Brunei, Cambodia, Burundi, China, Chile, Colombia, Costa Rica, Cape Verde, Djibouti, Dominica, Dominican Republic, Ecuador, Egypt, El Salvador, Fiji, Georgia, Ghana, Grenada, Germany, Guatemala, Haiti, Honduras, Iceland, Israel, Côte d’Ivoire, Japan, Jamaica, Jordan, Kyrgyzstan, South Korea, Kuwait, Kazakhstan, Libya, Madagascar, North Macedonia, Mali, Morocco, Mauritius, Oman, Maldives, Mexico, Mozambique, Malawi, Niger, Hong Kong SAR, China Macao SAR, China, Palestinian Territories, Montenegro, Vanuatu, Norway, Nepal, Suriname, Nicaragua, New Zealand, Paraguay, Pakistan, Papua New Guinea, Guinea-Bissau, Qatar, Romania, Moldova, Philippines, Rwanda, St. Kitts & Nevis, Lesotho, Senegal, Sierra Leone, St. Lucia, Sudan, Trinidad & Tobago, Thailand, Tajikistan, Tonga, Togo, Turkey, United Kingdom, Burkina Faso, Uruguay, Uzbekistan, St. Vincent & Grenadines, Vietnam, Namibia, Samoa, Eswatini, Zimbabwe, Indonesia, Serbia – more than twice the number of BIS coverage. The last map is World Bank 2021 data with readings for 154 countries, which is closer to reasonable levels of coverage for those seeking a global view.

One of the glaring divergences between the World Bank and BIS datasets is China’s trajectory. The World Bank data suggests that China has gone from a negative gap in 2021 to a positive one in 2022, which is consistent with the PBOC easing while the rest of the world’s central banks were tightening. In contrast, the BIS data suggest that China’s gap became more negative in 2022 compared to 2021. As described previously, the World Bank data appears to include only domestic sources of credit, whereas the BIS includes domestic and foreign credit. Thus the data is essentially saying that, in 2022, domestic credit in China rose while foreign credit evaporated.

- 1As a reminder, in the IMF’s MAC DSA model published in 2021, the coefficient for credit gaps as an independent variable is positive with respect to the dependent variable, which is the probability of a sovereign stress event.

- 2Argentina, Australia, Brazil, Canada, China, Chile, Colombia, Denmark, Ireland, Austria, Czechia, Finland, France, Germany, Greece, Hungary, India, Israel, Italy, Japan, South Korea, Mexico, Malaysia, Belgium, Hong Kong SAR, China, Luxembourg, Netherlands, Norway, New Zealand, Poland, Portugal, Russia, Saudi Arabia, South Africa, Singapore, Spain, Sweden, Switzerland, Thailand, Turkey, United Kingdom, United States, Indonesia

- 3Antigua & Barbuda, Algeria, Azerbaijan, Albania, Armenia, Angola, Australia, Barbados, Bangladesh, Belize, Bosnia & Herzegovina, Benin, Solomon Islands, Brazil, Brunei, Cambodia, Burundi, China, Chile, Colombia, Costa Rica, Cape Verde, Djibouti, Dominica, Dominican Republic, Ecuador, Egypt, El Salvador, Fiji, Georgia, Ghana, Grenada, Germany, Guatemala, Haiti, Honduras, Iceland, Israel, Côte d’Ivoire, Japan, Jamaica, Jordan, Kyrgyzstan, South Korea, Kuwait, Kazakhstan, Libya, Madagascar, North Macedonia, Mali, Morocco, Mauritius, Oman, Maldives, Mexico, Mozambique, Malawi, Niger, Hong Kong SAR, China Macao SAR, China, Palestinian Territories, Montenegro, Vanuatu, Norway, Nepal, Suriname, Nicaragua, New Zealand, Paraguay, Pakistan, Papua New Guinea, Guinea-Bissau, Qatar, Romania, Moldova, Philippines, Rwanda, St. Kitts & Nevis, Lesotho, Senegal, Sierra Leone, St. Lucia, Sudan, Trinidad & Tobago, Thailand, Tajikistan, Tonga, Togo, Turkey, United Kingdom, Burkina Faso, Uruguay, Uzbekistan, St. Vincent & Grenadines, Vietnam, Namibia, Samoa, Eswatini, Zimbabwe, Indonesia, Serbia